MOMBASA, Kenya, Nov 7 – Insurance brokers have been urged to invest strategically in cybersecurity to counter money laundering and terrorism financing risks and support Kenya’s bid to exit the Financial Action Task Force (FATF) grey list.

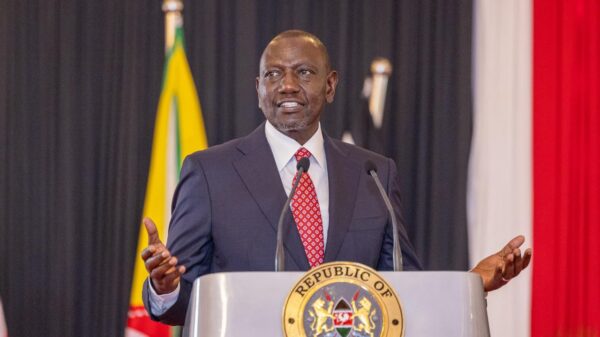

Speaking in Mombasa during the 19th Annual Conference of the Association of Insurance Brokers of Kenya (AIBK), Senior Counsel Mohammed Nyaoga said the rapid digital transformation sweeping through the insurance industry has shifted threats from physical to cyber domains, demanding stronger safeguards.

“If customers are to have confidence and trust in a digitally driven system, then we must put in place adequate safeguards to guarantee the safety of the systems that hold their data,” he said.

The four-day conference, themed “The Future of Insurance: Igniting Innovation, Securing Tomorrow”, has brought together more than 500 insurance practitioners to discuss emerging risks, innovation, and regulatory reforms.

SC Nyaoga noted that over 70 percent of insurers in Kenya are now accessible through digital platforms — including mobile apps, portals, and chatbots — allowing customers to buy policies, file and track claims, and receive support remotely.

He said the integration of technology has enhanced efficiency, reduced administrative costs, and improved customer satisfaction through automation.

“Artificial Intelligence and Machine Learning have transformed underwriting, risk assessment, and fraud detection. They make it easier to detect fraud more accurately, thereby reducing exposure from manual processes,” he explained.

Nyaoga added that technology has enabled innovative insurance products such as telemedicine and micro-insurance, where flexible daily or weekly payments have improved financial inclusion and supported Universal Health Coverage (UHC).

“For the insurance sector to thrive in this digital ecosystem, we must anticipate challenges and reconfigure our strategies. Insurers need to retool their boards, management, and staff for optimal performance,” he advised.

AIBK National Chairman John Lagat said the sector stands at a crossroads as technology, regulation, global risk, and local realities converge, offering both challenges and opportunities.

“The interplay of mobile-money infrastructure, fintech, and insurance is yielding new models of inclusive insurance such as pay-as-you-go, peer-to-peer, micro-insurance, and embedded insurance,” said Lagat.

He noted that insurers are increasingly leveraging artificial intelligence and data analytics to tailor products to customer segments and specific geographies.

“We have strong examples of Kenyan insurers leveraging data, digital partnerships, and new distribution models. This not only strengthens their businesses but also the ecosystem as a whole,” he added.

Despite this progress, Lagat observed that Kenya’s insurance penetration remains below 3 percent, compared to the global average of over 7 percent, though growth is steady and most listed insurers are recording positive net income.

He also raised concerns over the reporting structures and penalties for brokers who fail to comply with the Financial Reporting Centre (FRC) requirements on Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT).

Kenya was placed on the FATF grey list in 2024 for deficiencies in its AML, CFT, and Counter-Proliferation Financing (CPF) frameworks.

Insurance Regulatory Authority (IRA) CEO Godfrey Kiptum urged brokers to take the lead in addressing compliance gaps.

“It is not a matter for IRA or the Central Bank alone; it is for the public good. We encourage you to ensure full compliance so that Kenya can be removed from the grey list,” he said, noting that Kenya could soon remain the only grey-listed country in East Africa if corrective measures lag.