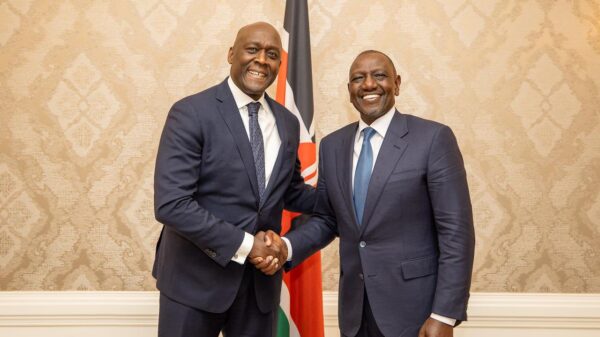

NAIROBI, Kenya, Jan 26 – President William Ruto has expressed confidence in the future of Kenya’s economy, citing a recent upgrade by global credit rating agency Moody’s, which revised the country’s outlook from negative to positive.

Speaking during a church service in Nairobi on Sunday, Ruto said the improved credit rating as a testament to the strengthening of Kenya’s economy, attributed to measures implemented by his administration to reverse a downward economic trend.

“Just yesterday, we got good news about what God is doing in healing our economy,” he said.

“Working together, we have seen inflation numbers, exchange rates, and interest rates come down.”

Moody’s attributed the outlook change to an improved likelihood of easing liquidity risks and better debt affordability over time.

Default risk

The agency cited signs of reduced domestic financing costs due to recent monetary easing measures and the Kenyan government’s efforts to improve fiscal management.

Despite the positive outlook, the new rating has sparked mixed reactions. Some economists have questioned the country’s economic stability, pointing out that Moody’s capped Kenya’s credit rating at Caa1.

A Caa1 credit rating signals poor credit standing, indicating a high risk of default. It is one of the lowest possible ratings, which considers the issuer in question as highly speculative and near default on its debt obligations.

The Caa1 rating serves as a warning that investing in this entity carries a significant risk of financial loss.

While acknowledging the positive outlook, Moody’s admitted that the rating reflects elevated credit risks stemming from very weak debt affordability and high gross financing needs relative to funding options.

“Additionally, Kenya also faces significant liquidity risks and environmental and social challenges, including those arising from climate events,” the agency noted.

In 2022, Moody’s rated Kenya at B2, a better rating compared to the current Caa1.

A B2 credit rating indicates that while a government is still at high risk of defaulting, it is considered capable of meeting its financial obligations.