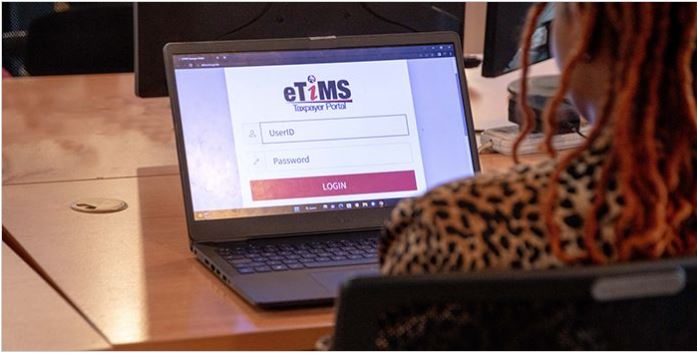

NAIROBI, Kenya, Jan 16 — Sugarcane farmers risk enduring an unfair tax burden unless the Kenya Revenue Authority (KRA) urgently differentiates the application of the electronic Tax Invoice Management System (eTIMS) for the sector, a sugar lobby group has warned.

The Sugar Campaign for Change (SUCAM) says the blanket rollout of eTIMS to sugarcane farming ignores the economic realities of primary agricultural production and could result in farmers paying taxes on gross receipts that do not represent real income.

In a policy position released on Thursday, the group argues that the system, while well-intentioned, is misaligned with the long production cycles, informal cost structures and buyer-controlled payment systems that define the sugar industry.

“The problem is not tax compliance; farmers have always complied where the law is clear and fair,” said SUCAM Director Michael Arum.

Arum said the real issue is the attempt to apply a commercial invoicing system to a farming activity that does not operate like a normal business.

Smallholders dominate sugarcane farming in Kenya supplying more than 90 percent of the cane milled locally. Most cultivate less than a hectare and wait between 18 and 24 months from planting to harvest before receiving payment.

During that period, farmers incur significant costs, including land preparation, fertiliser, weeding, harvesting arrangements and farm security, much of it paid informally and without documentation.

Gross value

According to SUCAM, eTIMS records only the gross value of cane delivered to mills, based on buyer-initiated invoices raised by millers.

“These invoices do not capture the expenses borne by farmers and therefore cannot [be] used as a fair basis for assessing taxable income,” Arum said.

“What millers generate are payment statements, not sales invoices in the normal tax sense. Treating these documents as proof of taxable turnover fundamentally misunderstands how income [is] generated in sugarcane farming.”

The lobby group warned that relying on gross cane proceeds could lead to the application of Turnover Tax, a regime designed for small traders with predictable margins.

Taxing net income

SUCAM argues this would contradict the Income Tax Act, which taxes net income and allows the deduction of expenses wholly and exclusively incurred in production.

“Gross cane proceeds are not profit. In many cases, they barely cover production costs,” Arum said. “Taxing farmers at source on that basis would mean taxing losses, not income.”

The group also raised concerns about cooperative societies, which often act as intermediaries between farmers and millers.

Under current arrangements, cooperatives receive cane payments only to distribute them to members, after deducting agreed advances or service charges.

SUCAM said imposing eTIMS obligations on cooperatives for total cane deliveries would wrongly classify them as trading entities.

“Cooperatives are agents, not sellers of cane,” Arum said. “Conflating farmer income with cooperative revenue creates a real risk of double taxation without any corresponding benefit to the exchequer.”

Under the VAT Act, supplies of unprocessed agricultural produce by farmers are exempt, a provision SUCAM says clearly applies to raw sugarcane.

The group argues that buyer-initiated invoicing does not change the nature of that supply or create new VAT obligations for farmers or cooperatives.

SUCAM is now calling on KRA to issue sector-specific administrative guidance recognising sugarcane farming as primary production deserving differentiated treatment.

The organisation said KRA should use eTIMS as a traceability and transparency tool, not as a mechanism for income assessment in the sector.