By Radhika Bhachu

A few years ago, I asked a group of friends—educated, employed and financially stable—how they were growing their wealth. Most weren’t. Their money sat in bank accounts, quietly losing value to inflation.

It left me wondering: if people with education and access weren’t investing, what about everyone else?

That question feels increasingly urgent as Kenya makes headlines for its embrace of digital assets. Parliament has passed the Virtual Asset Service Providers (VASP) Bill, placing Kenya among the first African countries to establish a comprehensive framework for regulating cryptocurrencies. The conversation is exciting—blockchain innovation, regional leadership, and positioning Kenya as Africa’s fintech hub.

But are we having the right conversation?

The VASP Bill is, in many respects, a smart move. It provides regulatory clarity, addresses Financial Action Task Force concerns, and signals Kenya’s seriousness about participating in the digital economy. Bringing stablecoins under Central Bank oversight shows foresight about the future of payments.

Yet an uncomfortable reality sits beneath the optimism. While we debate blockchain innovation and crypto regulation, 58 percent of Kenyans still lack basic financial literacy. The 2024 FinAccess Household Survey shows only 42.1 percent of the population can correctly answer basic questions about inflation, interest rates and risk diversification.

Kenya’s national savings rate stands at just 11.9 percent, less than half that of Uganda and Tanzania—despite Kenya’s higher financial inclusion rate of 84.8 percent. The irony is striking. We have regulatory frameworks for sophisticated digital assets, but we have not solved the basics.

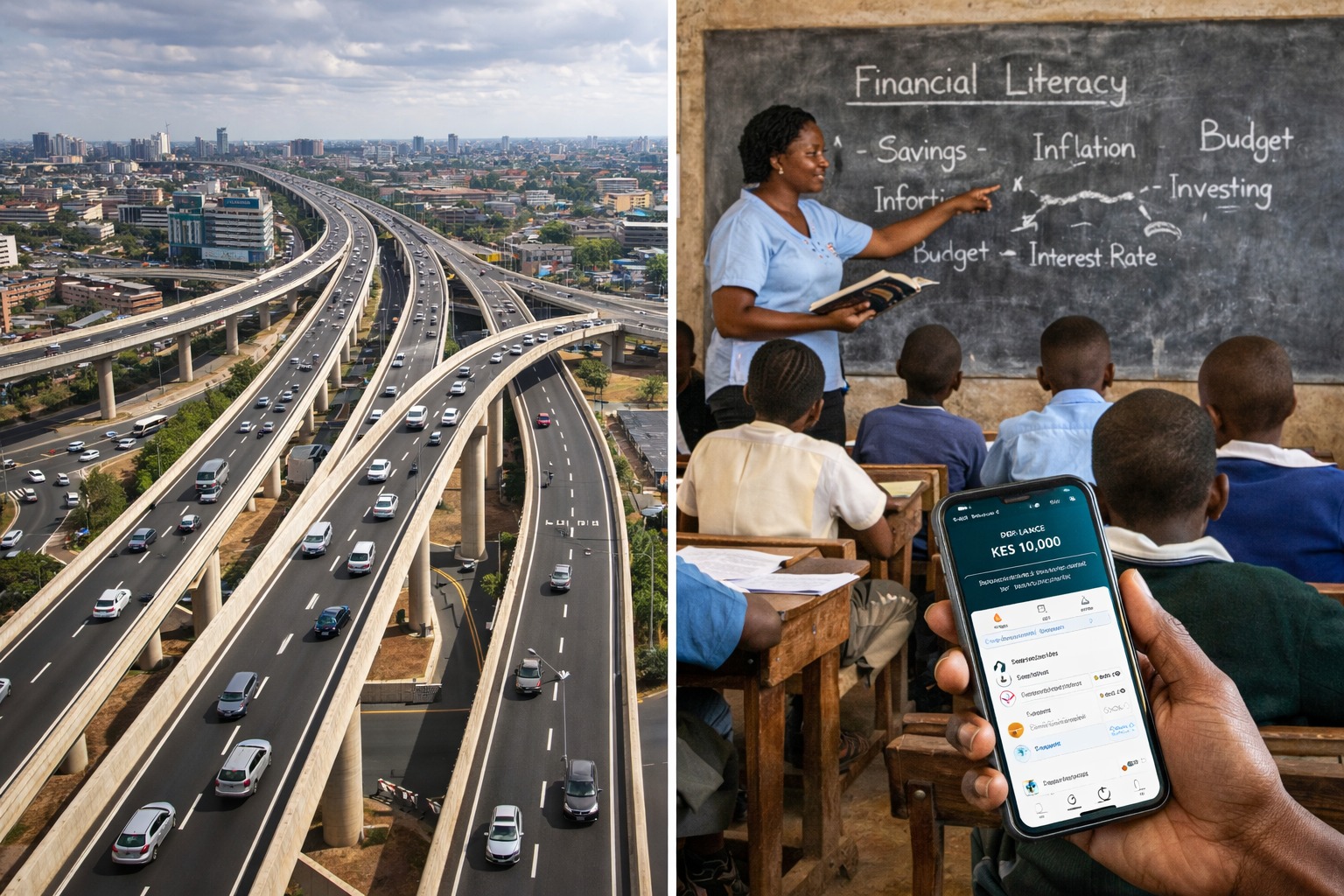

It’s like building an expressway before teaching people how to drive.

To be fair, Kenyans are resourceful. During recent dollar shortages, many turned to stablecoins to settle international obligations and hedge against shilling volatility—an observation also noted by the IMF. That ingenuity is impressive. But it also reveals a deeper problem: people are navigating complex financial instruments because they lack simple, affordable and trusted ways to preserve and grow wealth.

Ask yourself this: should someone trying to protect their savings from inflation really have to understand blockchain technology, manage crypto wallets and navigate digital asset risks? Or should there be straightforward, accessible investment options available through regulated, familiar channels?

The question is not whether Kenya should embrace crypto. The question is whether we are laying the right foundation first.

Consider why M-Pesa succeeded. Not because it was the most advanced technology globally, but because it solved a real problem in a way that ordinary Kenyans understood. It met people where they were. It built trust through simplicity and reliability—not complexity.

Financial literacy could be Kenya’s next M-Pesa moment, if we choose to prioritise it.

Before becoming Africa’s crypto hub, we need to become Africa’s wealth-building hub. That means education before innovation, access before complexity, and trust before scale.

Education matters more than we often admit. Every Kenyan should understand how inflation erodes purchasing power, why diversification reduces risk, and how compound interest builds long-term wealth. These are not abstract ideas; they determine whether households achieve financial security or remain vulnerable. Yet we do not teach them systematically.

Access must also be genuinely inclusive. More Kenyans should be investing in simple asset classes—bonds, money market funds, diversified portfolios—before being nudged toward sophisticated digital assets. Technology has already lowered barriers, with platforms allowing investments from as little as KES 500. But awareness remains low, and many still believe investing is “only for the wealthy.”

Trust, meanwhile, must be earned and protected. The VASP Bill’s focus on consumer protection and anti-money-laundering safeguards is welcome. But trust in finance also comes from transparency, education and confidence in traditional investment vehicles—not regulation alone.

So what would balanced progress look like?

It would mean directing some of the energy currently devoted to crypto regulation into nationwide financial literacy initiatives. It would mean embedding investment education in schools, partnering across public and private sectors to create simple wealth-building products, and using technology not because it is cutting-edge, but because it solves real problems.

The VASP Bill does create opportunities. International crypto firms may set up regional hubs here. New jobs could follow. Kenya could indeed become a gateway to Africa for digital assets.

But here is the real question: would we rather be known as the country hosting crypto company offices—or as the country where ordinary citizens are building wealth, educating their children and planning dignified retirements?

This is not an either-or choice. Kenya can participate in the digital asset economy while ensuring its people have the financial foundations to benefit from it. But one must come before the other.

Kenya has always been a pioneer—from mobile money to digital finance. Yet true pioneers do not just chase what is new; they build what is necessary. And what Kenya needs most right now is not another regulatory framework, but millions of citizens who understand how to grow their money, who have access to appropriate tools, and who are building lasting financial security.

The crypto debate will—and should—continue. Kenya should help shape the global digital asset economy. But as we license virtual asset service providers and regulate stablecoins, we must not lose sight of the fundamentals.

Financial inclusion is not measured by how sophisticated our fintech ecosystem looks. It is measured by whether ordinary people are actually becoming wealthier, whether they understand their choices, and whether they can make informed decisions about their financial futures.

Technology moves fast. Education takes time. Trust is built slowly. We need all three—but in the right order.

The question is not whether Kenya should embrace crypto. It is whether we are willing to do the less glamorous work of financial education and inclusive access first. Because technology without understanding is not innovation—it is simply a new way for people to make costly mistakes.

Let’s get the fundamentals right. Then we can confidently build anything on that foundation.

Radhika Bhachu is CEO and co-founder of Ndovu Wealth, a licensed fund manager and digital investment platform. She has over 14 years of international experience in financial services, having previously worked at BlackRock Investment Management in London.