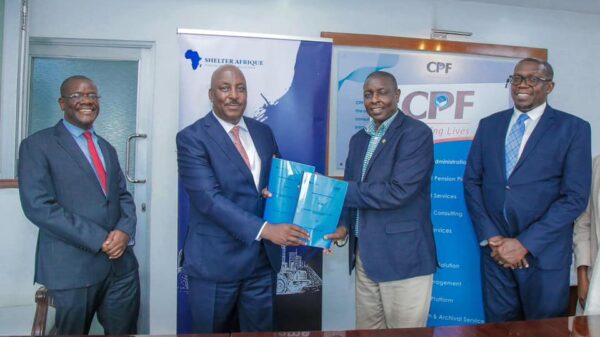

Visa General Manager for East Africa, Sunny Walia with I&M Bank CEO, Kihara Maina at the launch of the cards.

NAIROBI, Kenya, Mar 7 – I&M Bank has partnered with Visa Kenya to launch the I&M Bank Visa Infinite Credit Card and the I&M Visa Platinum Debit Card in Kenya for its Premium clients.

Speaking at the launch of the cards, I&M Bank’s CEO, Kihara Maina says the products builds upon the bank’s reputation for developing tailor-made products and services.

“We are constantly looking for new ways to offer our customers enhanced speed and convenience when it comes to payments through integrated services, and I believe that the Bank’s investment in a robust IT platform and Card Management system has helped us in achieving this milestone as we celebrate today,” Kihara added.

The I&M Visa cards come with benefits that cover travel such as global emergency assistance where Visa is able to lock your account in case you lose your card, provide you emergency cash and send you a replacement card.

Infinite Credit Card and the I&M Visa Platinum Debit Card will offer customers unparalleled services and privileges, both locally and abroad that look to enhance exclusive lifestyles with no boundaries.

Visa General Manager for East Africa, Sunny Walia said the credit and debit card are the latest additions to the suite of products aimed at the high net worth segment.

“The bank now joins an elite team of banks that issue Visa Infinite and Platinum Cards in Kenya to their high net worth clients in Kenya.”

Other benefits include concierge services and free unlimited airport lounge access in more than 800 LoungeKey lounges globally.

In addition, both cards offer shopping benefits on special visa offers and promotions, worldwide acceptance in over 20 million merchant establishments and digital access to the card benefits.

Users of both cards will further enjoy other benefits from I&M Bank such as enhanced security from the I&M Safe Card App, that allows customers to block and unblock their card anywhere anytime straight from their phones.

I&M Bank recently launched new distinctive product bundles tailor-made for its key business segments namely: Premium, Business and Young Professionals.

These new card products are part of the specially packaged banking solutions developed for th I&M Premium Select segment, which covers high networth individuals and I&M Premium Esteem segment which covers mid-career executives.