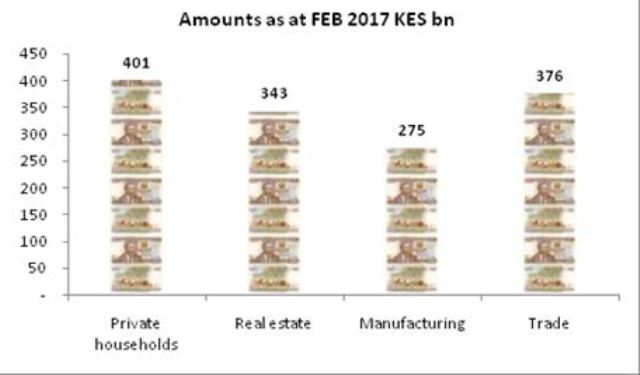

NAIROBI, Kenya, Jun 8 – Credit to the private household is the best performing hitting an all-time high of 17.5 percent of total private sector credit.

This is according to the Central Bank of Kenya data which indicates that since the passing of the interest rates controls law in August, private households’ credit has expanded by Sh35 billion.

The growth of this credit line, which is mostly secured by a payslip, goes to finance items such as household items, personal cars, school fees, medical care or trips.

Credit to the real estate sector has been the second best performing category, with a 4 percent increase.

At the same time, credit to the manufacturing sector and SMEs has contracted by Sh5 billion with manufacturing sector now only representing 12 percent of total private sector credit.

Analysts at Standard Investment Bank research say data is not surprising as the capping of interest rates would trigger a shift in collateralized lending.

“While we expect credit growth to remain subdued, there remains no clear guidance from management on loan growth and risk mitigation strategies,” SIB analysts said in a report.