NAIROBI, Kenya, Oct 26 – Kenya has been spared from being blacklisted by global anti-money laundering body the Financial Action Task Force (FATF) following its 24th plenary meeting in Paris this month.

In June of this year the FATF had said Kenya did not meet the requirements for Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT).

The Task Force particularly singled out the absence of a law on terrorism financing, as one of the pertinent issues that could lead to Kenya being blacklisted and countermeasures taken against the country if action was not taken by October 2012.

A Kenyan delegation comprising of officials from the National Treasury, the Central Bank of Kenya, the NSIS and the Financial Reporting Centre (FRC) attended October’s meeting and made a comprehensive presentation on actions which the Government has implemented to comply with the FATF requirements to improve the country’s AML/CFT regime.

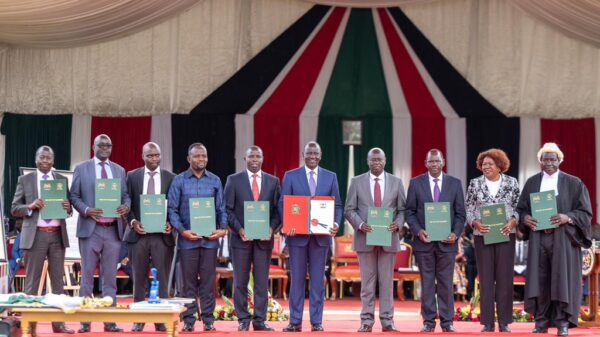

FATF concluded that the steps taken by Kenya including the enactment of the Prevention of Terrorism Act, 2012; the Capital Markets (Amendment) Act, 2012; the Proceeds of Crime and Anti-Money Laundering (Amendment) Act, 2012; and the establishment of the Financial Reporting Centre among other measures were sufficient.

“This is an achievement we all should embrace and support the Government in its efforts to further improve Kenya’s AML/CFT regime,” Finance Minister Njeru Githae said in a statement released on Friday.

He added that the government aims to intensify its efforts to address the outstanding issues, which include making the Financial Reporting Centre fully operational and development of regulations required under the Terrorism Act 2012 among others.

The business community has been increasingly concerned over the country’s inadequate money transfer system, which did not meet international standards and the challenges it would present in carrying out transactions abroad.

Organisations such as the Kenya Association of Manufacturers and the Kenya Bankers Association lobbied the government to pass an effective money laundering law that aligns with international law.

According to the US State Department’s money laundering and financial crimes country database of 2011, Kenya’s financial system may be laundering over $100 million each year.