NAIROBI, Kenya, Apr 8 – The Agricultural Finance Corporation (AFC) has written off Sh6 billion of non-performing loans owed by farmers.

This comes as a relief for thousands of farmers who have over the years been locked out of credit access due to inability to repay their loans.

AFC puts the amount of non-performing loans, comprising 1,632 clients, at close to Sh7 billion.

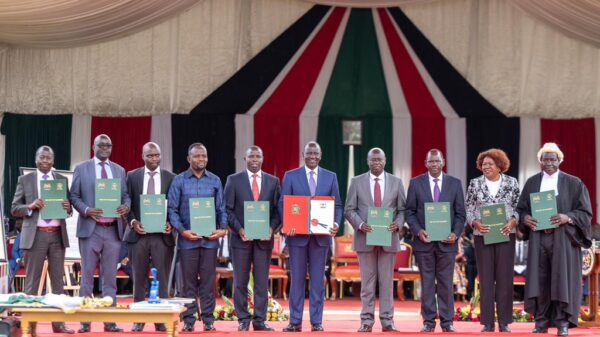

Making the announcement on Thursday, Agriculture Minister William Ruto said with the implementation of the new in-duplum rule, clients are expected to pay Sh1 billion while AFC and the Ministry of Agriculture would offset the balance freeing up money for farmers to continue borrowing.

“I am calling on those who accrued huge debts and interest that they now have an opportunity to redeem their loans and collateral and renew their engagement with AFC by paying off their loans,” Mr Ruto said.

The introduction of the new rule will make it possible for farmers not to pay interest rates that exceed the principal amount borrowed.

Mr Ruto said this development would allow for suspension of interest accruals making it possible for farmers to repay debts with little difficulty.

“There are (farmers) who have borrowed less than Sh100,000 but are now meant to pay sums close to Sh1 million because of interest that has accumulated over the years,” Mr Ruto said.

In essence the in duplum rule means farmers who fail to repay their loans will be expected to only pay double the principal amount. The rule is also aimed at stopping financial institutions from continuing to load customers with interest charges on a debt that is non-performing.

The challenge for farmers has been changing weather patterns that have affected their crop output making it hard for them to repay their loans.

With the rule now in place, the Agriculture Minister believes farmers will be better placed to address the bottlenecks they face in accessing financial services.

Under the in-duplum rule, the maximum amount a bank or financial institution can claim from a non-performing customer is capped, such that the interest charged and payable cannot exceed the principal amount outstanding at the time when the loan stopped performing.

This means that if for example, you borrow a sum of Sh10,000 from a commercial bank and you fail to repay, the maximum capital and interest chargeable should total Sh20,000.

The Agriculture Minister however cautioned that the corporation was not a charitable organisation and urged farmers to make good on their loans and make valid efforts to repay their debt.