By Dr Mohamed Omar

The Kenyan constitution envisaged a participatory approach to policy-making where public policy, including fiscal policy, is developed with the participation and contribution of the citizens. There has hence been a rich discourse on tax policy and regulatory frameworks. Such deliberations have been, and continue to be, instrumental in developing a tax system that is in harmony and aligned with the country’s economic and social context. What are the pillars of an effective tax system and how might these be realised?

An effective and efficient tax system conforms to the principles of taxation, which include equity, neutrality, efficiency, predictability, simplicity, and fairness. A tax system that takes into account these principles ensures that not only is the tax borne proportionately, but also the distortionary effect of taxation is minimised. To that end, a number of policy and administrative measures have either been adopted or are in the process of being institutionalised.

First, the annual Finance Acts and the occasional Tax Laws (Amendments) make changes with a view to bringing clarity to sections of the laws, entrenching good practices, expanding the tax base or introducing legislation to curb tax avoidance and evasion. Being participatory and benefitting from the submissions to the National Treasury from diverse range of stakeholders including business member organisations and professional bodies, these amendments routinely attract robust, and healthy, debates.

Second, to design an effective tax system, it is imperative that the tax regime is guided by a national tax policy. A national tax policy is an overarching framework that broadly sets out parameters for taxation. These include the rules and guidelines for regulating taxation, taxes to be levied, and the governing principles of the tax system. In the quest to align with the principles of taxation, a national tax policy offers a medium-term planning horizon for taxpayers thereby infusing predictability, as it is reviewed every 5-10 years depending on the jurisdiction. It is in recognition of this that the country has now commenced initial considerations revolving around the development of a national tax policy.

Third, with the Medium-Term Expenditure Framework that sets out a three-year public spending plan in place, the development of the corresponding Medium-Term Revenue Strategy is currently underway. The introduction of the Medium-Term Revenue Strategy helps bring alignment between the expenditure and the revenue mobilisation sides, by formulating a host of tax system reforms and revenue mobilisation mechanisms.

Fifth, countries give tax incentives for a number of reasons: supporting specific sectors where there are skill gaps by incentivising investors with the potential to facilitate skills transfer, attracting investment and spurring economic growth, promoting exports, creating employment or enabling strategic national programmes such as Vision 2030 and the Big 4 Agenda. The idea is that by foregoing potential revenue, the country expects a multiplier effect. A robust monitoring framework that routinely undertakes cost-benefit analysis therefore becomes a requirement to gauge the efficacy of different tax expenditure provisions. That way, incentives that do not serve the intended purposes may be discontinued, while maintaining those that help the country accrue economic benefits.

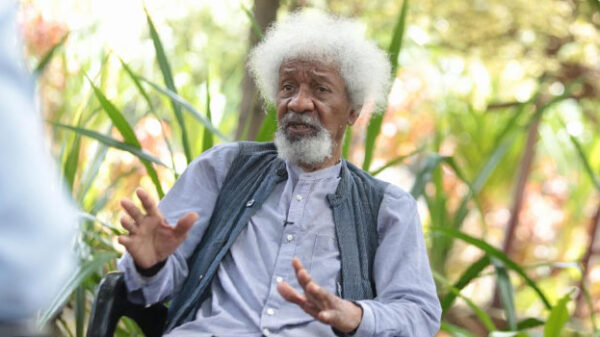

Dr Mohamed Omar, Commissioner, Strategy, Innovation and Risk Management Department at KRA