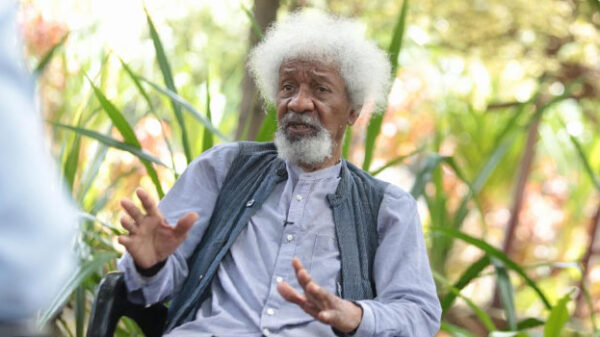

Haji and Kinoti spoke during a joint press briefing with managers of ive local commerial banks/ CFM -Moses Muoki

NAIROBI, Kenya, Mar 5 – The Director of Criminal Investigations (DCI) George Kinoti used the anecdote of disagreements between a wife and husband on Thursday to explain his current working relationship with the Director of Public Prosecutions Noordin Haji, who dismissed reports of a conflict as wishful thinking.

“Would you leave your wife over such a small issue?” the DCI asked the reporter who posed the question.

Word is that the two are at loggerheads, a situation that lay bare on Tuesday, after a prosecutor told a Nairobi court that DCI officers had decided to arraign the Managing Director of the Kenya Ports Authority (KPA) Daniel Manduku before approval by the DPP.

“It will be an issue of concern if it happens another time,” a pensive DCI told journalists.

Kinoti had assumed the podium after the DPP asked him to explain, publicly, whether he had said mean words about his office, as reported on a leading newspaper on Thursday.

“He is here. DCI tell these people the truth,” a visibly agitated DPP said in Swahili.

That their bromance is long dead, the DPP said, is a narrative of “corrupt cartels” and asked journalists “to avoid being used by them.”

“It is a wishful thinking, we are brothers and we will continue to deliver on our mandate,” the DPP asserted.

But without divulging much details, he said, like in any other working area “teething problems do occur.”

But does the Tuesday incident fall under that?

“Sincerely, what the DPP has said…you know in the criminal justice sector, such things they usually do happen. If such an incident recurs, that is when we can say there is a problem,” DCI Kinoti said.

The DPP said the widely cited incident that exposed disharmony between their officers was an isolated case and could not be used to sum their working relationship.

“We are not fighting at all,” Haji told journalists, “these are teething issues in any institution and should not be interpreted to mean we are at war.”

He teasingly wondered if reporters wanted them “to go physical.”

The Tuesday incident earned Kenya Ports Authority (KPA) Managing Director Daniel Manduku freedom, as the DPP insisted in reviewing his file.

It is the sitting resident magistrate that rescued what was an ugly situation by allowing an adjournment.

Manduku is being probed in a multi-million shillings scandal, involving well-connected individuals in the country.

In this case alone, the DPP said he has four files saying with a little patience from journalists, “justice will be served.”

But why was the DPP agitated?

“I was not angry with you (journalists). It is the reports that I pocketed some money made me so angry,” he explained to journalists shortly after the briefing.

During the event was, Haji announced his office had plea-bargained with five local banks where “suspicious transactions” occurred during the National Youth Service scandal, for differed prosecution.

Through the process, the DPP has recovered a Sh385 million from five leading banks in the country.

They are the Kenya Commercial Bank (KCB), Equity Bank Limited, Co-operative Bank of Kenya Limited, Standard Chartered Kenya Limited and Diamond Trust Bank Kenya Limited.

The monies were paid into the Prosecutions Fund account and will be restituted to the public following the existing laws and procedures, DPP Haji said.

He added that, “in addition to the penalties and as part of the agreements, the banks committed to review and implement a number of corrective measures.”

-What the banks committed to do-

The affected banks committed to review the Know Your Customer (KYC) compliance status and ensure proper supporting documentation for customer transactions.

They also agreed to enhance their existing Anti-money laundering and combatting the financing of terrorism monitoring systems, in a bid to enable real-time monitoring of digital transactions.

The DP said the banks will also take disciplinary action against their staff involved in violating banking rules.

“They will also conduct extensive Anti-Money laundering training for all staff and their board of directors,” Haji said.

Also, in the list of must do include undertaking remedial measures designed to enhance monitoring, on an ongoing basis, of all complex “unusual, suspicious or large transactions undertaken by customers.”