NAIROBI, Kenya, Nov 24 – Abojani Investment CEO Robert Ochieng has urged Kenyan households to move beyond short-term income survival and begin deliberately owning productive assets, calling this the surest path to long-term wealth creation and financial independence.

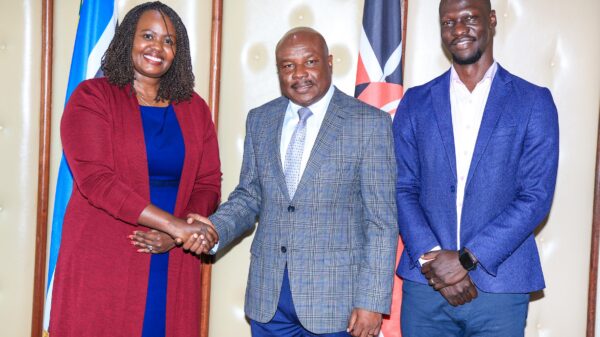

Speaking at the 5th Abojani Economic Empowerment Conference on Saturday, Ochieng said this year’s theme marks the next phase of Abojani’s mission.

While last year’s edition focused on helping households build financial “staying power,” the 2025 conference pushes Kenyans to embrace an ownership economy by shifting from consumption to accumulating assets that appreciate over time.

“We are going a notch higher in ensuring that households have ownership,” Ochieng said.

“If you own stakes in the companies whose products you consume, then as you spend, you’re also getting wealthier. That is what we want for all African households.”

He cited equities, rental property, and government securities as core building blocks of the ownership economy and stressed that the biggest barrier for most households is information, not income.

“Once households have the right information, they are more likely to invest. Curiosity drives knowledge and with knowledge, you make the right decisions,” he said.

Ochieng said Abojani is focused on democratizing financial knowledge through social media, webinars and simplified content, and urged the creation of low-barrier tools such as USSD services, WhatsApp-based investment channels and mobile-friendly pension products to reach informal and low-income earners.

Making information relatable, he said, is key to catalyzing participation.

“If information is in a language people relate to, they respond. It becomes a nudge: a call to action to participate in the ownership economy,” he said.

He challenged attendees to work consistently towards their first Sh1 million through disciplined saving and investing.

Citizen-owned economies

Bank of Kigali CEO Dr. Diane Karusisi, who graced the conference as keynote speaker, echoed Ochieng’s call, emphasizing that true economic independence begins when citizens own the enterprises and assets that drive their prosperity.

“This is not just rhetoric,” she said. “It’s the difference between being a mere consumer and being an owner of productive assets that generate revenues. That’s how generational wealth is created.”

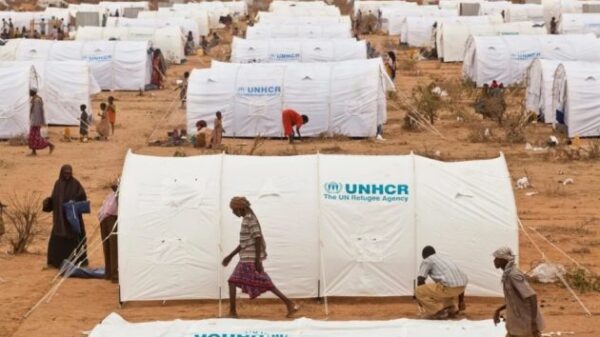

Dr. Karusisi highlighted Africa’s “ownership gap,” noting that while the continent is rich in youth and entrepreneurial energy, most of what is consumed is not African-owned.

“This lack of ownership is costing us our future,” she said. “It increases economic vulnerability, affects food and energy security, and even contributes to broader social instability.”

She outlined the role of financial institutions as enablers of the ownership economy, citing Bank of Kigali’s operations across banking, insurance, pensions, capital markets, financial literacy, and technology.

“Being part of the ownership economy means you have to play the long game. Wealth is not created overnight. It is built over five, ten, twenty, thirty years and even beyond,” she said.

“From an early age, we need to tell our children that money is not just for spending. You need to be someone who produces and owns,” she added, calling for sustained efforts to foster financial education.

Dr. Karusisi also called on African businesses to think long-term and formalize operations.

“Many businesses, especially in the informal sector, do not survive past five years. Women entrepreneurs, in particular, must plan beyond short-term gains and focus on building sustainable, long-term enterprises that can be passed on to future generations.”

She highlighted the central role of regional integration in shared prosperity, noting that cross-listing companies on the Rwanda and Nairobi stock exchanges opens ownership opportunities for citizens across borders.

She also flagged tokenization, a model allowing conversion of physical or financial assets into digital tokens, as a tool to democratize access to global assets.

“Imagine owning a fraction of real estate in Singapore or a company in the Philippines,” she said. “Tokenization allows Africans to participate in global wealth creation, even with small means.”

Long-term saving

The Retirement Benefits Authority (RBA) added its voice, with Assistant Director for Market Conduct John Keah noting that pensions offer one of the most powerful yet underutilized pathways to wealth creation.

Keah noted that as the RBA marks 25 years, pension assets have grown to Sh2.5 trillion, or 15 per cent of Kenya’s GDP, a mark he said points to the transformative power of structured, long-term saving.

“Retirement benefits can be used as a platform to generate wealth,” Keah said.

“Retirement planning is not just about surviving old age; it is a foundation for ownership.”

Despite this potential, only 7.5 million of the country’s 30 million working adults save for retirement—a coverage rate of just 26 per cent.

Keah said this gap underscores the importance of platforms such as Abojani that expand financial awareness.

“We commend Abojani for creating awareness. Information drives participation, and participation drives prosperity,” he said.

Keah highlighted advantages of pension schemes that many households overlook, including strong long-term returns with many schemes posting above 20 per cent in 2025.

He also cited tax benefits on contributions, investment income and payouts, wide diversification across up to 15 asset classes, and professional fund management that ensures security of savings.

He added that pensions also offer capital-building potential that can help retirees start businesses or undertake major projects.

Keah urged Kenyans to start saving early and consistently, noting increased life expectancy means many people live up to 30 years beyond retirement age.

“If not yesterday, start today. Even small amounts compound into significant wealth over time,” he said.

Keah added that the RBA is working with stakeholders to expand pension uptake, especially in the informal sector.

“Our focus now is the informal sector. We must bring them into pension saving if we are to secure the country’s financial future,” he said.