NAIROBI, Kenya, Aug 25 – Family Bank is lining up a private placement worth approximately Sh6.2 billion ($47.9 million) as it seeks to bolster capital buffers and finance its next growth phase, following a surge in its latest half-year profits.

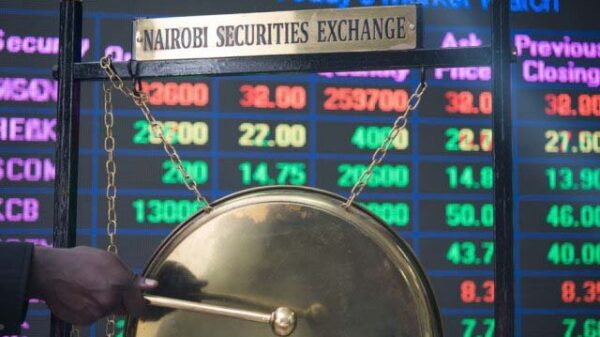

The mid-tier lender, which has announced plans to list on the Nairobi Securities Exchange by 2026, posted after-tax earnings of Sh2.2 billion for the six months to June, a 36.6 percent jump from Sh1.6 billion in the same period last year.

“From our simulations, we are looking at more than Sh6 billion ($46.4 million) to support the next growth phase. Capital support, of course, is not limited to Sh6 billion because we also project to have retained earnings,” said CEO Paul Ngaragari.

“We definitely need capital to support the rapid growth, but that capital is not for regulatory purposes or lending since our liquidity is at 53 percent. For every asset you deploy, you must charge capital, which is why the ratio continues to be strained,” he added.

The private placement, targeting select sophisticated investors, is expected to close at the end of August.

The fundraise is viewed as crucial to shoring up the bank’s capital adequacy, which stood at 15.9 per cent against risk-weighted assets—just 1.4 percentage points above the minimum regulatory requirement of 14.5 per cent.

The lender is also seeking to expand its regional footprint, with an immediate focus on the Ugandan market. It further plans to enter the Democratic Republic of Congo and Tanzania within five years.