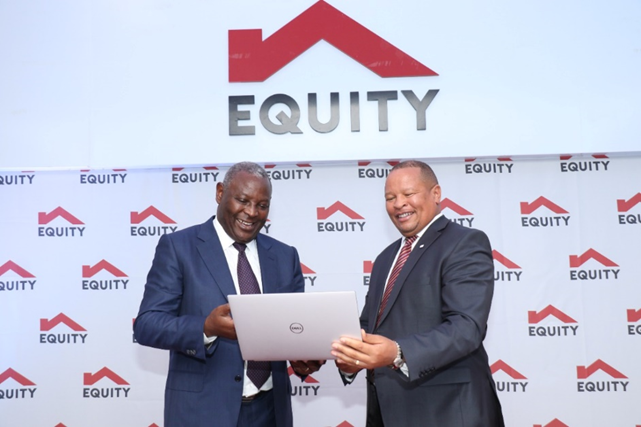

NAIROBI, Kenya, Mar 12 – Equity Group has been ranked the second strongest banking brand globally and the first in Africa by achieving high rankings in Brand Finance’s 2024 Brand Strength and Brand Value assessments.

In its third consecutive appearance in the Banking 500 rankings, the lender ascended from 4th to 2nd position in the World’s Top 10 Strongest Banking Brands with a brand strength index score of 92.5 out of 100, earning an elite AAA+ brand strength rating, marking a 0.1 point BSI improvement on its 2023 ranking.

Additionally, Equity’s brand value increased by $22 million, reaching $450 million, securing it the tenth position in Africa.

Equity’s Managing Director and CEO, James Mwangi, attributes the success to strong governance, customer-centric practices, and a commitment to innovation.

“We are further excited to see that 4 of the top strongest 10 banks in the ranking are also from Africa. As we continue to anchor our business on our purpose and support the day-to-day lives of our customers, it fuels our commitment to innovation and excellence, driving us to redefine standards and pioneer transformative solutions in the financial industry,” Mwangi said.

Each year, Brand Finance, a renowned brand valuation consultancy, assesses 5,000 major brands and releases about 100 reports, ranking brands worldwide across various sectors.

The annual Brand Finance Banking 500 ranking features the world’s top 500 most valuable and strongest banking brands.

While trust remains crucial in customer decision-making for banking services, Brand Finance’s research highlights the significance of articulating a sense of purpose and meeting customer needs effectively.

The Brand Finance Banking 500 report is highly regarded as the industry’s foremost authority, evaluating financial institutions’ brand value using quantitative and qualitative metrics such as brand strength, loyalty rate, and revenue forecasts.

2023 saw improvements in performance across Equity’s subsidiaries, with Equity BCDC, Equity Bank Rwanda, and Equity Bank Tanzania making strong strides.

The Group remains committed to South Sudan, as seen in its offering of new lending products, while bolstering the Ugandan entity, which has gained strong traction in market share and significance.

Reflecting on the rankings, Brand Finance’s CEO David Haigh noted the dominance of China’s mega-banks in brand value while highlighting the increasing strength of local banks.

“As the world’s top banking brands reach new heights, China’s mega-banks continue to dominate at the top of the brand value ranking. Another key insight from our 2024 data is that local banks increasingly outshine their larger counterparts in brand strength,” Haigh said.

“Dominant brands thrive in singular markets with limited competition, while banks expanding into multiple markets may successfully augment their brand value but risk diluting brand strength.”

Brand Finance defines brand value as the net economic benefit that a brand owner would achieve by licensing the brand in the open market.

This is, however, different from the valuation of a company’s assets. They also define brand strength as the efficacy of a brand’s performance on intangible measures relative to its competitors.