NAIROBI, Kenya, Jun 5 – Kenyan banks will be required to publish information on the cost of credit on a website set up by the Central Bank of Kenya and the Kenya Bankers Association.

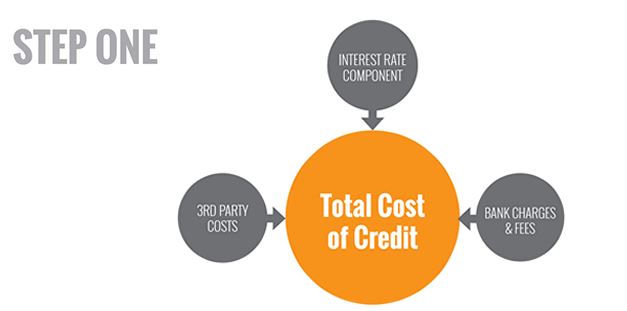

www.costofcredit.co.ke will contain annual percentage rate loan repayment schedule and any additional costs constituting the cost of credit which allows customers shop for the best rates.

Banks will initially provide information for personal loans and mortgages with other types of credit incorporated later.

The website is expected to be accessible to the public this week after a test run by the banks.

The portal comes in the wake of reduced credit by the public due to fixed pricing of loans after the rate capping law that came into effect in September 2016.

Genghis Capital analysts say this publicly available information will encourage “rate shopping” for customers enabling them to make best-informed decisions as well as discipline banks to credit affordable.

“We expect this move to boost transparency in the banking industry,” comments a Genghis Capital brief.

Banks will be required to also put a link to this site on their own websites to ease customer accessibility of the same.