The offer opened on Monday and will close on July 4 with a minimum subscription per client at Sh100,000 with additional multiples of Sh50,000/FILE

The bond will be issued in two tranches with the first tranche amounting to Sh3 billion – with the option to take up to an additional amount of up to Sh1 billion in a green shoe option – while the second tranche will amount to Sh2 billion to be issued next year.

The offer opened on Monday and will close on July 4 with a minimum subscription per client at Sh100,000 with additional multiples of Sh50,000.

The listing on the Fixed Income Securities Market Segment of the Nairobi Securities Exchange is expected on July 30, 2014.

The notes will mature on July 8, 2019 and carry a semi-annual fixed rate of interest of 13 percent per annum.

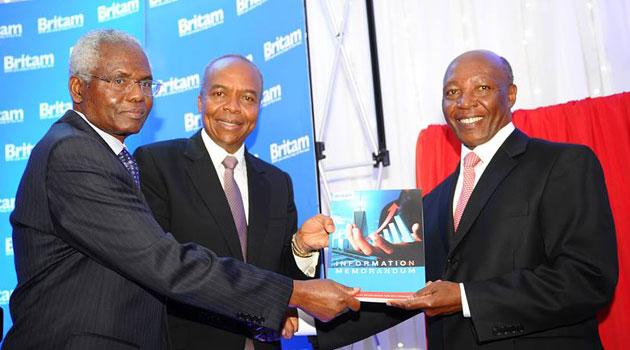

Britam Chief Executive Officer Benson Wairegi says the funds will be used to support several strategic initiatives including real estate opportunities, private equity opportunities, local and regional business growth and ICT investments.

“Some of the money could go to acquiring land and doing developments on the land that we have but right now we are doing the business cases. We have land in Mlolongo (10 acres), Ngong (21 acres) and in Kilimani (1.5 acres); we continue to look for more land in cities outside Nairobi and outside Kenya like Kampala and Kigali,” he said.

The company is earmarking the 10 acre piece of land for a shopping mall, with the Kilimani piece of land ideal for a hotel.

Some of the property market segments earmarked include master planned communities, suburban outlet malls, commercial office parks, budget hotels and mixed use properties- retail, offices and residential properties.

“The design of this transaction and our solid fundamentals makes this bond issue an attractive investment vehicle for the investors. Apart from offering an attractive return of 13pc per annum, the bond will be listed on the Nairobi Securities Exchange, offering the investors an opportunity to trade and cash-in any time before the five year contract,” said Wairegi.

On his part, Britam Board Chairman Ambassador Francis Muthaura said the company’s vision is to be the largest Pan African diversified financial services group.

“We have sustained positive growth over the years driven by good performance of all business units within the group. Our regional expansion agenda is a significant catalyst for future growth. This program will provide a pivot to our long-term funding which will bolster the envisaged growth of the group. Investing in Britam offers the investors an opportunity for a diversified portfolio and also a portion of our growth narrative,” said Ambassador Muthaura.

The company’s shareholders approved a decision to acquire a 99 percent shareholding in Real Insurance Company.