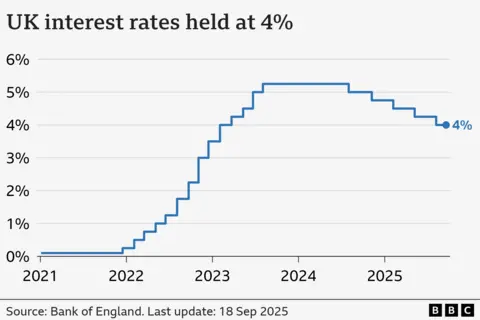

SEPT 18 – UK interest rates have been held at 4% as the Bank of England governor warned “we’re not out of the woods yet” in terms of rising inflation.

Analysts had not expected interest rates, which influence borrowing costs and returns on savings, to be cut given that prices are rising at nearly twice the Bank’s target rate.

The Bank said it expected inflation to return to its key target of 2%, but remains cautious on when it will again trim borrowing costs.

Alongside the interest rate decision, the Bank also announced it would reduce the amount of government debt it holds at a slower pace, coming just weeks after turmoil in the financial markets.

The Bank has cut interest rates five times since August last year after the pace of price rises eased.

However, since April inflation has been heading higher again – fuelled in part by rising food costs.

While it kept rates on hold this time, the Bank said that two of the nine members of its rate-setting Monetary Policy Committee (MPC) had voted to cut rates to 3.75%.

The MPC will meet two more times this year to discuss rates, but the Bank said it wanted to see evidence that price pressures were easing before cutting rates again.

“We’re not out of the woods yet so any future cuts will need to be made gradually and carefully,” said the Bank’s governor, Andrew Bailey.

The Bank also announced it would reduce the rate at which it sold its stock of UK bonds, which it amassed during the financial crisis and pandemic

As Chancellor Rachel Reeves prepares to announce the Budget in November, a higher cost of servicing Britain’s vast pile of debt risks reducing the amount of headroom she has against her self-imposed tax and spending rules.

The Bank of England bought £875bn worth of government bonds during times of crisis to support the economy.

It has been reducing the amount of debt it owns by about £100bn a year. But on Thursday it said that from October onwards, it would reduce that to £70bn.

Mr Bailey said the change would allow the Bank to carry on with its plans “while continuing to minimise the impact on gilt market conditions”.

By BBC