NAIROBI, Kenya, Sep 20 – Medical Insurance made an underwriting loss of Sh621.64 million in 2016, an increase of 427 percent from 2015.

This is according to Insurance Regulatory Authority Annual Report which also indicates that motor private continued to make losses that hit Sh3.29 billion in 2016.

Personal accident losses were at Sh341.21 million.

“The general insurance segment in Kenya recorded loss ratios ranging between 58.4% and 62.7% during the last five years, against a global benchmark range of 50%-70%.

Aviation, medical and motor private classes are the only classes that recorded loss ratios exceeding this global benchmark at 158.2%, 75.0% and 75.8% respectively in 2016,” the report states.

Industry players attribute the high losses to the prevalence of fraud in the motor and medical segments.

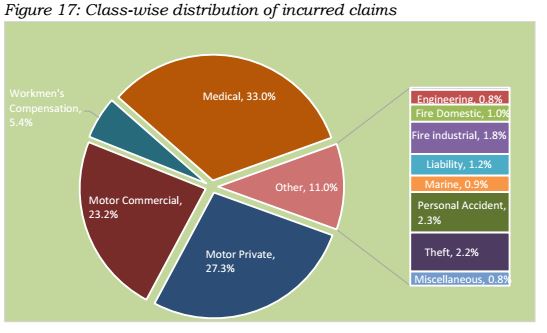

The general insurance business classes with the highest premium income incurred larger proportions of claims with medical incurring 33 percent of the total claims while motor classes of business incurred 50.5 percent of the total claims.

General insurance business underwriters incurred claims amounting to Sh54.86 billion, an increase of 11.8 percent from Sh49.05 billion incurred in 2015.

The report shows that gross premium income was Sh196.64 billion, representing a growth of 13 percent from Sh174.06 billion reported in 2015.

General insurance business contributed approximately two-thirds (62.6%) of the total gross premium income.

The industry asset base grew by 10.4 percent from Sh478.75 billion in 2015 to Sh528.75 billion in 2016 with 80.4 percent of the assets held in income generating activities.

According to the new report, the insurance penetration, which is the ratio of Gross Direct Insurance Premiums to Gross Domestic Product (GDP), declined from 2.88 percent in 2015 to 2.73 percent in 2016.

This decline may be attributed to higher nominal growth in GDP of 14.3 percent (at current prices) compared to nominal growth in gross direct premium of 13.2 percent.