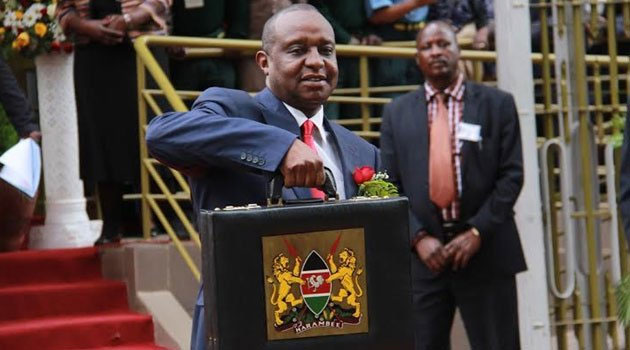

In an analysis by PricewaterhouseCoopers the levy will not only affect road users but also other heavy users of petroleum products including train operators and power generators/FILE

NAIROBI, Kenya, Jun 9 – Inflation is likely to go up following the increase of the Roads Maintenance Levy by 50 percent in the 2016/2017 budget.

In an analysis by PricewaterhouseCoopers the levy will not only affect road users but also other heavy users of petroleum products including train operators and power generators.

“These increased costs will be passed on to end consumers which is likely to increase the cost of transporting goods and people within the country which will ultimately affect headline inflation,” noted PwC Tax Partner Rajesha Shah.

The Roads Maintenance Levy was increased from Sh12 per litre to Sh18 per litre.

Last month, Kenya’s inflation fell to 5 percent year-on-year in May from 5.27 percent a month earlier, according to the Kenya National Bureau of Statistics.

This was the lowest reading since June 2013, as cost of food and housing and utilities went up at a slower pace.

Meanwhile, Shah is of the view that the budget taxation measures were more focused on not necessarily raising revenue income but improving business environment which will in the long run grow the economy and improve the cost of living.

For example on kerosene he says, the introduction of tax may not necessarily have a huge impact on consumers since the prices are way low, and will instead help in curbing fuel adulteration which has on the hand has adverse impact on motorists.

“It is hoped that the introduction of the duty, and by extension an increase in the price of kerosene, will discourage harmful practices such as its use in adulteration of other petroleum products, which has been prevalent following excise duty removal on the product in 2011,” he said.

Shah says the extension by one year, of the transition period for the imposition of VAT on petroleum products which was to expire in September 2016, will however help in stabilizing the general cost of fuel this year.

Duty on iron and steel metals, he says, was also a good move to improve the business environment which has a great impact on local manufacturers.