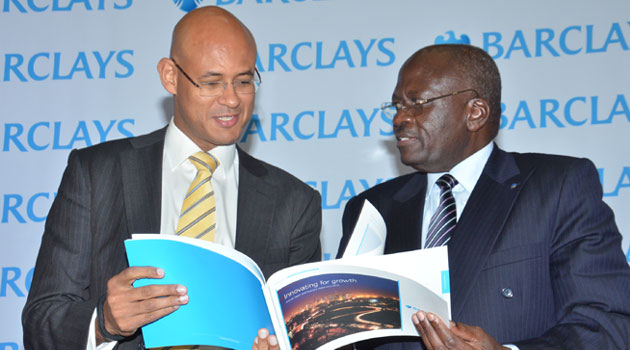

Okello said the main aim is to attract and retain the best personnel in the board to remain competitive in the market/CFM BUSINESS

Chairman Francis Okello said the bank will however first carry out an independent market survey to determine what other boards of listed firms are paying their directors.

He said the main aim is to attract and retain the best personnel in the board to remain competitive in the market.

“We should be recognising the time that the directors are spending on managing the bank affairs but it will done in a very responsible manner,” Okello said.

He said the remuneration has been constant since 2010 hence the need to do some adjustments in line with the market changes and the bank’s growth.

Okello was speaking on Friday during the 35th Annual General Meeting (AGM) where the shareholders approved the move.

“What we normally do is that you carry out an independent market survey to ensure that you are in line with the industry in terms of what kind of fees get paid to listed company’s boards. And that is normally done by professional firms,” the chairman added.

During the AGM, shareholders approved a final dividend recommendation of 70 cents per share.

“While recognising our regulator’s desire for us to maintain strong capital ratios and in light of the revised prudential guidelines, the dividend payout is conservative compared to historical highs in prior years,” Okello explained after the shareholders enquired why the dividend has dropped in the last two years consecutively.

In 2011, total dividend of Sh1.50 per share was paid to shareholders, then went down to Sh1 in 2012 and then to 70 cents last year.

The revised Central Bank of Kenya (CBK) Prudential Guidelines to be effective in January 2015, requires all the banks to have a total capital to risk weighted assets of 14.5 percent from the current 10.5 percent.

The shareholders approved the bank’s financial statements for the year ended December 31, 2013 which reported an after tax profit of Sh7.6 billion.

A Sh788 million one off exceptional restructuring cost coupled with compressed interest margins led to a decline in profitability in 2013 compared to 2012.