NAIROBI, August 26 – The Cooperative Bank of Kenya has announced a 50 percent increase in pre-tax profit for the nine months ending September 30.

A statement from the bank released on Wednesday said profits grew to Sh2.59 billion compared to Sh1.73 billion recorded during the same period in 2007.

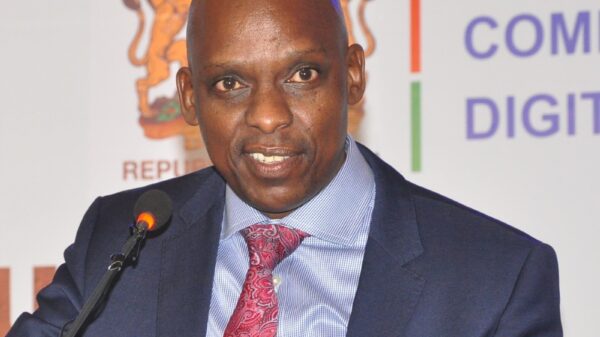

Managing Director Gideon Muriuki credited the results to the growth of interest income, which went up from Sh3.97 billion to Sh5.09 billion as well as an increase in loans advanced to customers which increased by 27 percent.

“The impressive performance by the bank during the nine-month period is a clear indicator that the bank is on course to hit the Sh3.4 billion target for the full year,” Mr Muriuki said in a statement.

The bank’s income also went up from Sh2.62 to Sh3.33 billion mainly due to an increase in non-funded income streams such as foreign exchange, fees and commissions on loans and advances.

Customer deposits also rose to Sh64.7 billion from Sh54 billion while the total assets increased to Sh78.4 billion.

The performance was also bolstered by the bank’s focus on enhanced service delivery strategy with better efficiency and key investments in Information Communications Technology.

Mr Muriuki also said the impressive performance was attributed to an increase in the bank’s branch network following the opening of 10 outlets during the period under review, which helped to increase the retail customer base.

“The bank continued to institute strong liquidity management measures leveraging on refurbishing the branch network across the country and opening new branches,” he said.

Mr Muriuki restated that performance in the period under review was in line with the bank’s strategic turnaround and said that they projected to open 30 additional branches by the end of 2009.

The bank also announced that the final tally of the just concluded Initial Public Offering was over Sh5.4 billion indicating a subscription of 81 percent against a set minimum success rate of 30 percent.

With a projected profit before tax of Sh3.4 billion, the bank’s capital base will rise to Sh14.2 billion placing it among the highest capitalised banks in the region, according to Mr Muriuki.