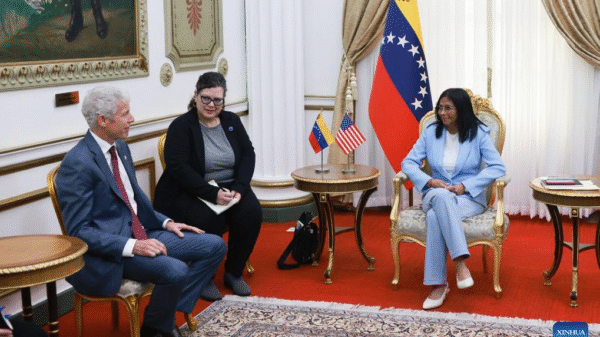

But according to Cytonn Investments CEO, Edwin Dande, President Kenyatta’s move was a bit too hasty as it may even do more harm than good in terms of ensuring affordable credit in the market/COURTESY

NAIROBI, Kenya, Aug 25 – Even as borrowers wait to feel the impact of the new interests rates capping law, much is still unclear on its implementation.

From the side of the borrowers, the move is a relief to them as loans will be cheaper while on the side of banks, this was a setback as it will lead to credit rationing especially to high risk borrowers.

According to independent Investment Bank Kestrel Capital East Africa, there are certain terms within the law that are yet to be fully clarified before we even begin the debate on who is the loser or gainer.

Some of the terms include, what base rate to be used, what credit facility the capping will apply to, as well as which financial Institutions to be affected apart from banks.

“It is unclear which of the Central Bank rates would be used. Currently, the Central Bank Rate (CBR) is at 10.5 percent and the Kenya Bank’s Reference Rate (KBRR) is at 8.9percent. The Central Bank could also develop a new base rate for the banking sector,” research analyst at Kestrel Capital Kuria Kamau says.

“It is unclear which credit facilities would qualify for the caps, that is, would it also apply on mobile loans, credit card lending, foreign currency lending and corporate bonds purchased exclusively by banks? It is unclear if it would apply for all loans retrospectively or just on new issues,” Kamau argues.

On financial institutions, Kamau says it is still not clear which financial institutions would be subject to the interest rate controls.

Currently only commercial banks and deposit taking microfinance institutions are regulated by the Central Bank are unlikely to be subject to the new law. However, non-deposit taking microfinance institutions and Savings Credit Co-operative Organisations are not but account for a lot of retail lending.

“Now, a policy framework would need to be developed to outline the implementation of the new law. The development of the policy framework is likely to take several months to complete and would be done in consultation with all stakeholders,” he says.

It is difficult to say what the actual impact on the economy and banking sector would be, as details of how it will be implemented are yet to be announced.

Moreover the impact of Full Year 2016 numbers on banks would be insignificant as the implementation is unlikely to happen before the end of 2016 due to development of the policy framework.

But according to Cytonn Investments CEO, Edwin Dande, President Kenyatta’s move was a bit too hasty as it may even do more harm than good in terms of ensuring affordable credit in the market.

He says it will be a matter of time to see banks shying away from the high risk borrowers arguing that has not been considered in the law.

“When now you cap interests rates to 14 percent, for the first instant we compare it with Brexit. It sounds good until you really get into it. Countries like Zambia have tried and reversed the course in like three months,” he says, “You try go to the bank right now, they won’t give you a loan, they will give to the people who are less riskier.”

President Kenyatta on Wednesday assented the Banking (Amendment) Bill 2015 into Law which will set a cap for lending rates on credit facilities at 4 percent above the base rate and a floor on deposit rates at 70 percent of the base rate.

The base rate will be set by the Central Bank and will apply to all financial institutions regulated by the CBK.