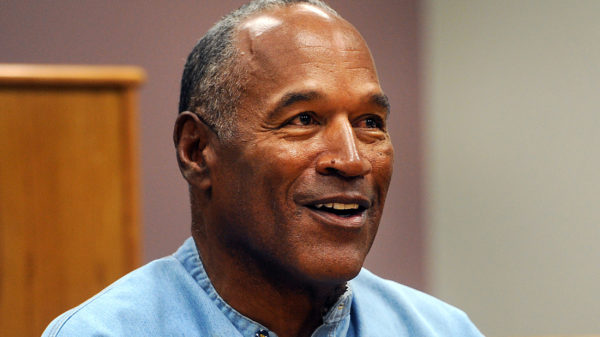

Capital FM’s renowned DJ Protege talks to The Sauce sharing his philosophies on money management.

The established deejay has built a name for himself as one of Kenya’s premier deejays. With industry experience spanning over 10 years, DJ Protege grew his love from music, beginning as a rookie in Moi University. For him, there’s nothing as exciting as getting your first paycheck from your first job/hustle and it is important to cultivate the right spending habits in your 20s.

The new feeling of independence and possibilities is euphoric and really that’s what drives us. However, since you came from a place of nothing, only surviving on allowances, it’s easy to get carried away or get trapped in some financial traps. I had the same feelings when I got my first job. Over time I made many financial decisions good and bad. What I came to realize is that school never provides you with the right money management skills.

That said, I’d like to share some financial tips I have learned along the way that many young people should know when getting out of school, some you’ll agree with, some you won’t, as long as you get something out of it. Here goes:

1. Be proud in your work/hustle: First, you don’t have to work in a white-collar job to make it in life, unfortunately, many generation Ys & early millennials realized this late. I’ve met several trolley boys in the CBD who earn between 1,500 to 2,000 per day ferrying luggage from point A to B. They average 30k to 40k per month on one hustle. This is much better than any entry-level job in the corporate world which will still require you to remit P.A.Y.E!

In my first hustle I used to sell bananas from Kisii, travelling overnight to buy them at around 250 to 350 bob a bunch, load them up in a bus at 50bob per bunch in transport cost, transport all of them to Marikiti at 300 per mkokoteni load, pay the middleman 50bob per bunch and sell each between 500 to 700 bob. By 10 am I’d be back in bed with 5-10k in my pocket, wake up the next day and do it all again.

2. Be wary of fast cash: During this time, you’ll find yourself making extra cash from various hustles, allowances and more as your ideas start to generate additional income. If you’re in the informal sector where cash is King, be wary of having lots of cash in hand lest you find yourself living from hand to mouth. This cash in hand really tempts you to spend on things you don’t need, that’s why many people seem to constantly be broke.

Notice, I did not say poor, there’s a difference, poor people don’t have the income, broke people do but can’t commit anything to save because they end up spending their money on useless things like alcohol, too many clothes, etc.

This was my biggest drawback when I started out deejaying, the club owner would pay me at the end of the night but most of the money would go back to buying drinks for my friends and girls and I’d go home with almost nothing.

The same thing applies to debit & credit cards? Leave those things at home unless it’s for a planned expense, easy access to your money will get you spending on unnecessary things.

3. Start saving immediately: It’s common sense to save for your future but it’s easy to postpone this in your early 20s. Don’t! Just like tithe, commit 10% to it and drop that into a fixed deposit account in your preferred bank or Sacco which brings me to my next point.

4. Open an account with a Sacco: Saccos provide the best saving opportunities and loan facilities when you’re starting out. Deposit your savings in this account and earn up to 10% interest in your savings. In addition, Saccos offer the best loan facilities, get up to 3 times your savings in loans at a 14% interest rate. What’s more, this interest rate does not fluctuate, unlike banks.

Take advantage of the power of compound interest, save 5k a month for 20years, that’s 3.9M clean! No Work, no sweat, no get rich quick gimmicks, just save! Turn 40 with a heavy nest egg!

5. Live within your means: This should be obvious but somehow, we get caught in the trapping of easy access to money, especially mobile money loans. Avoid them at all cost otherwise, you’ll find yourself living from paycheck to paycheck. There’s no shame living in an SQ or sharing an apartment. If your books are in the green in the end you have no one to impress but yourself.

6: Money & Alcohol: These two don’t mix, have a set entertainment budget, there’s no shame catching pints at your local or at your house, remember some of the best parties you ever had are when you had to scrounge for loose change to afford a bottle with your pals.

Eating out and tipping: It’s fun to eat out but don’t make it a habit, what you’ll spend on a meal at a fancy restaurant can feed you for a whole week, plus many fancy restaurants are overrated, go to the reviews section to see for yourselves. If you tip, consider that as money you’d have used in other things. That 50 bob you gave the watchman to look after your car is a whole loaf that you could have eaten for 3 days.

7. Living for the gram: When I started out we didn’t have Instagram, whatever we did didn’t need to get accounted for on the gram. Yet we were still happy and balled out. I guarantee you most of the people you see online have a double life.

There’s a trend in clubs where you can pay the barman 200bob to pose with a bottle of whatever you want, add another 25o bob you get the full sparkler treatment so that you can stunt on your pals on the gram.

8. Giving Loans: A cardinal rule is ‘don’t give out loans, especially to the family’. If your conscience eats you up, loan an amount you are prepared to lose. Ask yourself why can’t they get the loan from a bank or their own family, chances are you’re about to get played.

9. Remember, you can’t save everyone: Are you that person that they can run to during an emergency? Do you have that uncle that calls you when he hasn’t paid fees or needs a boost? Are you the VIP guest to some church building Harambee? Are you the plug when your pals need a ride? While it’s good to help out, keep your expenses limited to your close circle no matter what guilt trip they take you on. One of the biggest lessons you’ll learn is the ability to say ‘No’ or ‘I can’t afford it’ with a straight face and not lose sleep over it.

10. Loans for vehicles: There’s nothing wrong with taking out a loan for a car, sometimes you have to live a little and some vehicles are assets in themselves. Just make sure the car you get fulfills its purpose, getting you to work and your hustle. If it spends more time parked or ferrying friends from point A to B, you’re making a bad investment.

Tip: There’s a reason they say the car in front is always a Toyota. They’re relatively affordable to maintain, hardly lose their resale value and are very practical. Visit any big car garage in Industrial Area and see how many Range Rovers, Touaregs, Audis, BMWs are parked because the owner is fed up of constantly fixing it.

11. Dating for the guys: Another controversial one, unless you discover your soulmate, don’t bother getting into a committed relationship that takes you out of your comfort zone. It’s your time to play the field, let off steam and discover yourself. Spending money on expensive dinners, paying for hair, buying phones & other frivolous expenses is not your business, this is taking money away from your savings and in any case, she should be able to cater for her own needs.

If you find yourself in this trap chances are there’s some much older guy out there who’s doing the same on a much better scale for her, ask yourself how come chics your age hang out in the hottest clubs every week sipping Hennessey while you can only afford to contribute towards a bottle at the locals with your boys? You’ll discover the answer when you turn 30.

The proverbial plenty of fish in the sea is true: Have a look at the sponsor lifestyle that has really caught on, this is also very true for the sponsor ladies, they’re just better at hiding it.

12. Dating for the ladies: On the flip, ladies, you have no business supporting a man with no potential financially, keyword, ‘potential.’ Why would you spend money to buy a man drinks, let him stay in your house all day while you toil in the office? Chances are he’ll end up cheating on you in your own house. For God’s sake don’t get pregnant to hold on to a man, you’ll end up being miserable.

Alternative suggestion: One of my mentors once told me, if you want to be financially secure, get into an arrangement with a chic/guy. You can commit a fixed allowance to them per month as long as they’re there at your beck and call as you focus on your goals until you’re ready for that commitment. I can’t say I agree with this, but it provides food for thought.

13. Insurance and NHIF: It’s easy to suffer from a superhero complex when in your early 20’s, but this is the time you’re susceptible to 20-year-old stupid mistakes like accidents. Many employers provide cover but if you find yourself, without it pays to sacrifice to get one.

Get yourself an inpatient cover, it will be more affordable than a comprehensive one but will serve its purpose if needed. If you cannot afford one, start off with an NHIF cover, employers cover this cost but for the self-employed, it only costs 500/- per month.

14. Insurance & NHIF for your folks: Face it, the older you get, the more susceptible you will be to diseases and conditions. If you find your self-supporting your parents, it pays to get them on NHIF and when you can, get them an insurance cover.

NHIF also has a big part to play as with proper planning and informing them before any major surgery will see a large chunk of your bill catered for. I learned this the hard way when my dad urgently needed surgery, I had to take a loan for this to cater for a bill worth 350,000, something which would have easily been catered for with an annual cover worth 60,000.

Two years later I was redeemed when my dad required back surgery, this came to a rough cost of 500k, NHIF catered for around 180K while the Insurance catered for the balance, I did not spend a dime and my dad even got a private room in the hospital.

15. Unplanned pregnancies: Ok this will rub some people the wrong way but if you feel the time is right for you, by all means, go ahead. However, you have no business getting pregnant in your early 20s, this is really when you’re setting yourself up, getting your first job, starting out on your business, dating, discovering love, moving into your first house, traveling, etc. You’ll have the time to get kids later as they will be your comfort when older.

16. Planned Pregnancies: Bringing a child to the world is a beautiful thing. Since most of the time this is a planned thing, get covered for it. Once you decide to get a baby, most insurance companies will cover pregnancies from them the second year of maternity cover, so plan accordingly.

17. Investing: So you have your cash stacked up a bit and you’re thinking of ways to invest it? Why not, that’s the whole purpose of saving, isn’t it. Well, it pays to be prudent when investing. Here are some tips:

17. Investing: So you have your cash stacked up a bit and you’re thinking of ways to invest it? Why not, that’s the whole purpose of saving, isn’t it. Well, it pays to be prudent when investing. Here are some tips:

A: Invest in your field: Invest in something you have knowledge and experience with, if you’re a farmer, stick to that. I see so many people buying into greenhouses and have never worn gumboots in their lives, just take a look at the press and see how many people have lost millions in that venture. However everyday farmers are still making a killing? Why? They’re invested financially and personally.

B: Money Market Funds: This is one of the biggest traps you get sucked into as a young adult, some savvy sales guys from an insurance company sell you a saving fund facility where you have to contribute amount X for a set number of years to get returns worth a maximum of 10% per annum. What they don’t tell you is you will lose all interest if you withdraw before maturity. Why trap your savings in such a facility when you can earn the same while saving in a Sacco & still have access to your money in case of an emergency?

C: Land: Owning a piece of land is one of the biggest achievements you can ever have, doing so in your 20s is even better. When you decide to purchase land, remember, gone are the day’s people bought land for speculation especially in the outskirts of Nairobi. Ask yourself, do I really see myself living here? If you don’t, do you really think someone else does?

D: Mortgages: Don’t do it. The word literally means ‘death pledge’. There’s no property in Kenya that can give you half the returns you’ll get by just keeping your money in a fixed deposit account. What about land/asset appreciation? Well, there is an oversupply in the housing market. Plus the additional interest you will get over what you can charge for rent will make up for this appreciation.

E: Land Companies: Stay away from these companies’ guys! I can’t put it any other way. Think about it by the time they’re selling to you they must have purchased it from some old farmers, placed their mark up, included logistics costs, i.e. staff, advertising, a big-shot brand media personality ambassador and cost of hype according to the market.

These guys hire ‘investors’ to be part of their tours to visit the land, people who you’ll meet on the bus ride as you’re ferried from Kencom to some remote parcel of land that’s supposedly the next big thing. They will use these well-placed proxies to influence you to commit as they ‘fake’ commit themselves. If you’re not careful, you’ll end up with a useless piece of land in the middle of nowhere.

Instead, go to the ground. The best practice so far is to take time and identify the place you want to invest according to your budget, go talk to the locals, walk around and find out the conditions. Ever heard of 6 degrees of separation? Most likely you have an uncle who knows a friend whose father lives or owns in the area you would like. Take advantage of this.

Don’t be afraid to spend more if the land is better than a parcel in the middle of the bush, look for facilities close by, access to public transport, water connectivity, electricity and proximity to the tarmac. Never rush to make this commitment. Always ask yourself, “Do I see myself living there?”

18. Your time = Money: Start equating your time to money or potential to money, this will open up your thinking and avoid wasting it on useless or unnecessary things. You will stop doing things for free, it’s ok to take lower pays but if someone needs your services, chances are they are willing to pay for it. This includes advice for anyone not in your circle of friends. Someone asking you to a cup of coffee to run an idea through you? You’re being used. I see this with a lot with my lawyer friends.

19. Spend more to live closer to work: If you consider your time as money, you’ll spend less of it getting stuck in traffic commuting to work and home. The amount you’re trying to save will most likely get eaten up by using more in fare or fuel. Plus nothing beats the feeling of dashing home for a bit during work.

20. Finally, Don’t be a spectator: Your 20s allow you to take risks, you’re yet to get tied down by the commitments of raising a family, paying rent, school fees. It’s your chance to take chances, travel, try out business and hustles, get something you like doing, that’s how you’ll discover what you truly want to do with your life. Don’t pay attention to what the naysayers say, as long as it makes sense to you, you’ll be fine.

I hope this helps you make the right choice during this time.

What money management tips can you share that can help others in their 20s?

This article is written by Yoram Mwangi aka DJ Protege.