May 7 – First-time buyers and homeowners looking to remortgage are still facing a “significant challenge” when it comes to finding affordable deals, the Halifax has said.

The lender said house prices have been largely flat so far this year, and only saw a small increase in April.

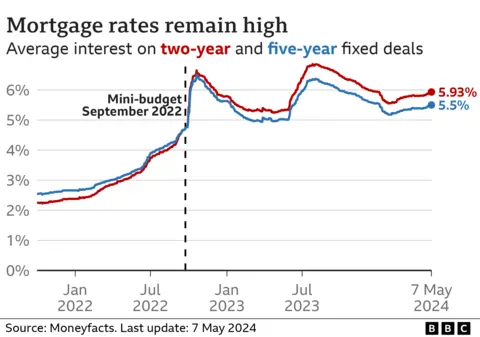

Mortgage rates have been rising in recent weeks, mainly due to expectations that the Bank of England will make fewer interest rate cuts this year.

However, a forecast from estate agent Savills suggests that house prices will rise by more than a fifth by the end of 2028.

Savills said it had upgraded its forecast for the next few years on expectations of a stronger performance from the UK economy together with steady cuts to interest rates.

Halifax said the average UK house price had risen by 0.1% in April, with a typical home now valued at £288,949.

Prices last month were up 1.1% from the same point last year, following a 0.4% annual rise seen in March.

Amanda Bryden, head of mortgages at Halifax, said the housing market was “finding its feet in an era of higher interest rates”.

“While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability,” she added, with activity and demand improving.

“However, we can’t overlook the fact that affordability constraints are still a significant challenge, for both new buyers and those rolling off fixed-term deals,” Ms Brydon said.

“Mortgage rates have edged up again in recent weeks, primarily as a result of expectations around future Bank of England base rate changes, with markets now pricing in a slower pace of cuts.”

The Bank’s latest decision on interest rates will be announced on Thursday, with most analysts predicting they will be left unchanged at 5.25%.

At the start of the year, many analysts had expected the Bank to make several cuts to its key interest rate in 2024, with the first predicted to take place in June.

But with inflation – the rate at which prices rise – not falling as fast as expected, forecasts of when the Bank will cut have been pushed back.

This change in expectations has had a knock-on effect on the mortgage market, pushing rates back up.

By BBC