NAIROBI, Kenya, July 13 – Local non-bank financial services provider Sanlam Kenya has launched Flexi Hela, an innovative, flexible savings solution with a guaranteed return.

The life savings product to be administered by Sanlam Life Kenya features a life cover for up to 4 dependent children with access to accrued savings within 24 hours at a zero-surrender cost.

In addition, it has an open-ended term that allows customers to enjoy the policy’s benefits and continue to save as long as the policy remains active. Its flexible nature allows savings contributions to grow at the declared interest rate over time, with withdrawals viable at any time and subject to no penalties.

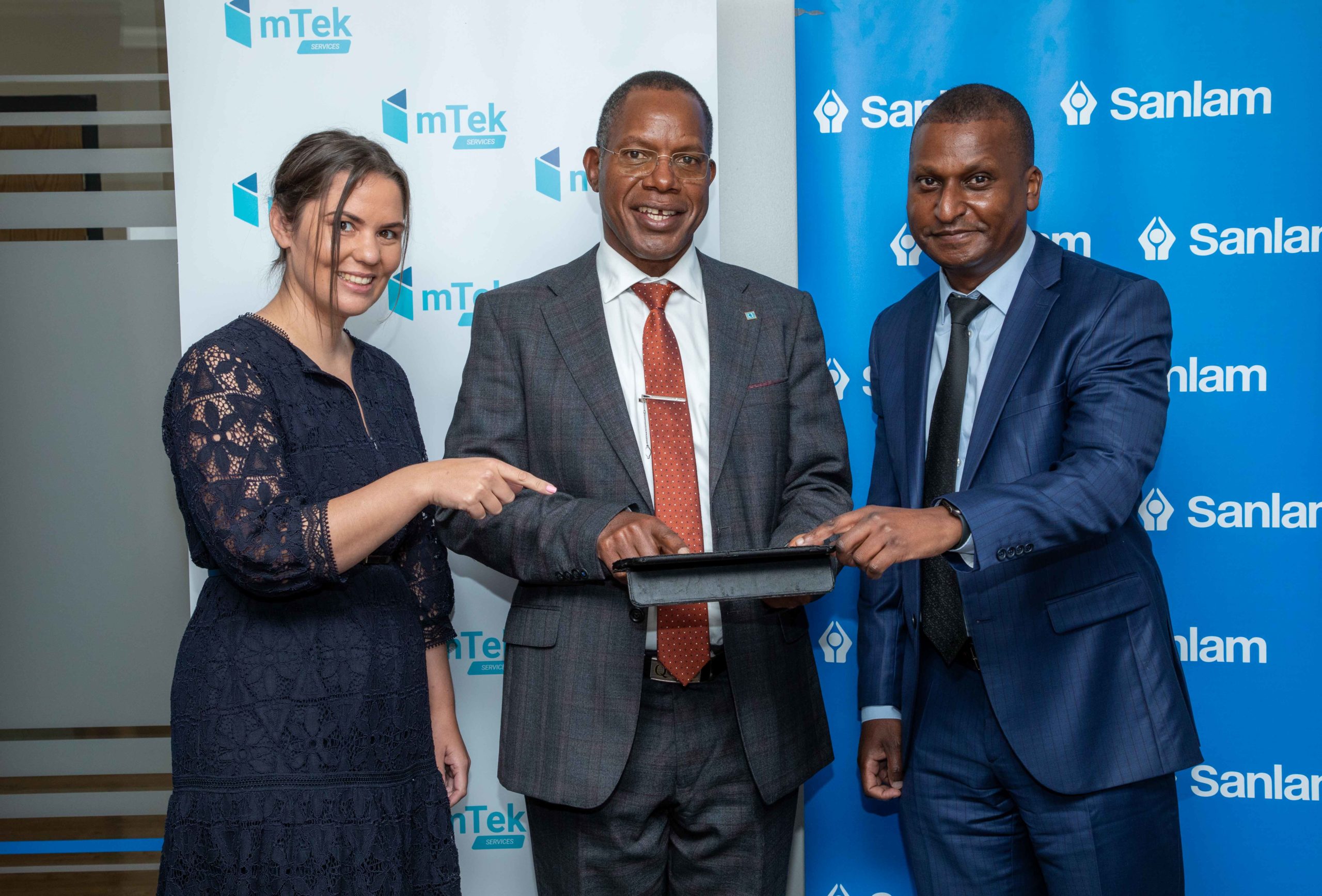

To provide an end-to-end digital distribution of Flexi Hela, Sanlam Kenya has partnered with mTek-Services, a local digital online insurance platform that provides an entirely paperless ecosystem for the insurance industry. Flexi Hela customers will use the mTek app to save and access their savings in real-time.

The product’s flexibility allows customers to adjust their savings limits and the life cover via the Sanlam customer portal, giving them the flexibility to adapt the product to their changing lifestyles.

Speaking during the launch, Sanlam Kenya CEO Dr Nyamemba Tumbo noted that the innovation is in line with Sanlam’s commitment to improving its product offering, digitizing its distribution channels, and delivering services more effectively to the market.

“Flexi Hela is our response to the developing needs in the market driven by customer-centricity. Through this strategic partnership with mTek, we aim to increase insurance penetration to the customer by allowing them the choice to exit at their will,” added Dr. Tumbo.

During the launch, mTek’s Chief Executive Officer, Bente Krogmann, said that Flexi Hela’s digital interface will create multiple touch points that will specifically enable ease of use and more transparency – with the use of the digital system contributing to the affordability of the product.

“With mTek’s digital platform, Flexi Hela customers will be able to make affordable and, most importantly, flexible insurance payments; without having to fill in any paperwork, providing them with security and peace of mind at their fingertips. In addition, customers should expect exemplary personalized customer services with full transparency”, said Ms Krogmann.

mTek is a leading insurance platform that allows customers to purchase insurance directly from providers while offering policy comparisons and filing claims directly from the customer’s smart devices.