NAIROBI, Kenya, October 20 – President Uhuru Kenyatta Wednesday ordered the removal of borrowers with less than Sh 5 million from the Credit Referencing Bureau (CRB) for a year, a move he said will cushion distressed borrowers from the harsh economic environment occasioned by the coronavirus pandemic

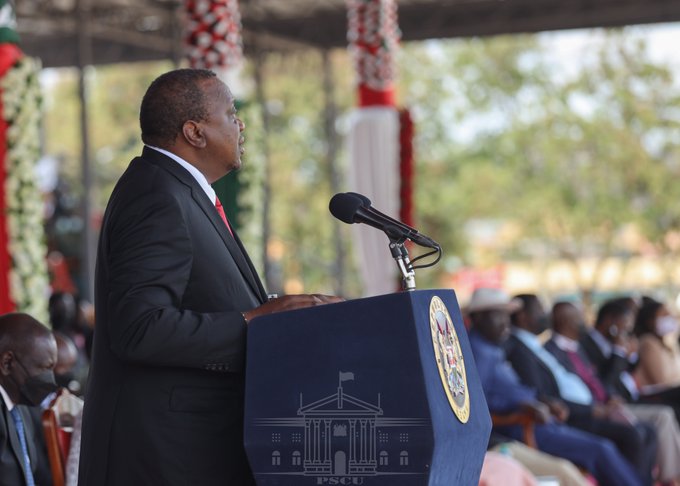

Kenyatta, who spoke during the Mashujaa Day celebrations held yesterday, directed the National Treasury to effect the moratorium effective October 2020.

Similarly, he noted that borrowers with loans below Shs 5 million listed with CRBs will not have that listing incorporated in their credit reports over the same period.

He noted that the move will provide relief particularly to MSMEs who continue struggling to get back to a sound footing following the adverse effects of the pandemic.

“The relevant authorities will, for loans less than KSh.5 million, effect a moratorium of listing in CRBs for a period of 12 months to end September 2022, Further, borrowers with loans below KSh. 5 million listed with CRBs from October 2020 to date will not have that listing incorporated in their credit reports for the next 12 months, ending September 2022,” he said.

In addition to foregoing measures and accelerating the country’s economic recovery, he urged all banks and financial institutions to accommodate customers who seek to restructure their banking facilities.

” In recognition of the importance of digital financial services, especially to the small scale traders and the household at large, I direct the National Treasury to engage all digital payment providers with an aim of deepening and expanding use of digital payment channels,” he added.

A survey conducted by Ipsos among Kenyans living in informal settlements in June revealed that 44 percent of Kenyans had loans in June with 55 percent of respondents saying they found it hard to pay the loans as a result of the COVID-19 pandemic.

The survey conducted between June 18 and 25 revealed that borrowing was higher in the rural areas at 45 percent compared to urban areas whose residents accounted for 42 percent.