NAIROBI, Kenya, Jun 17 – Facebook Inc., owner of WhatsApp, the most popular global social communication service, announced a payments service dubbed WhatsApp Pay that will work through its suite of mobile apps including WhatsApp mobile app.

The announcement of the payment service reverberated across the world due to the sheer scale of WhatsApp, which tallies 500 million Daily Active Users (DAU) and 2 Billion monthly users in 180 countries. WhatsApp is most popular, especially in emerging markets with the largest number of users such as India (200Mn) and Brazil (120Mn). This informs its target of the payment service to emerging markets with the first launch in Brazil and expected to be rolled out in Mexico, India and Indonesia.

How WhatsApp Pay will work

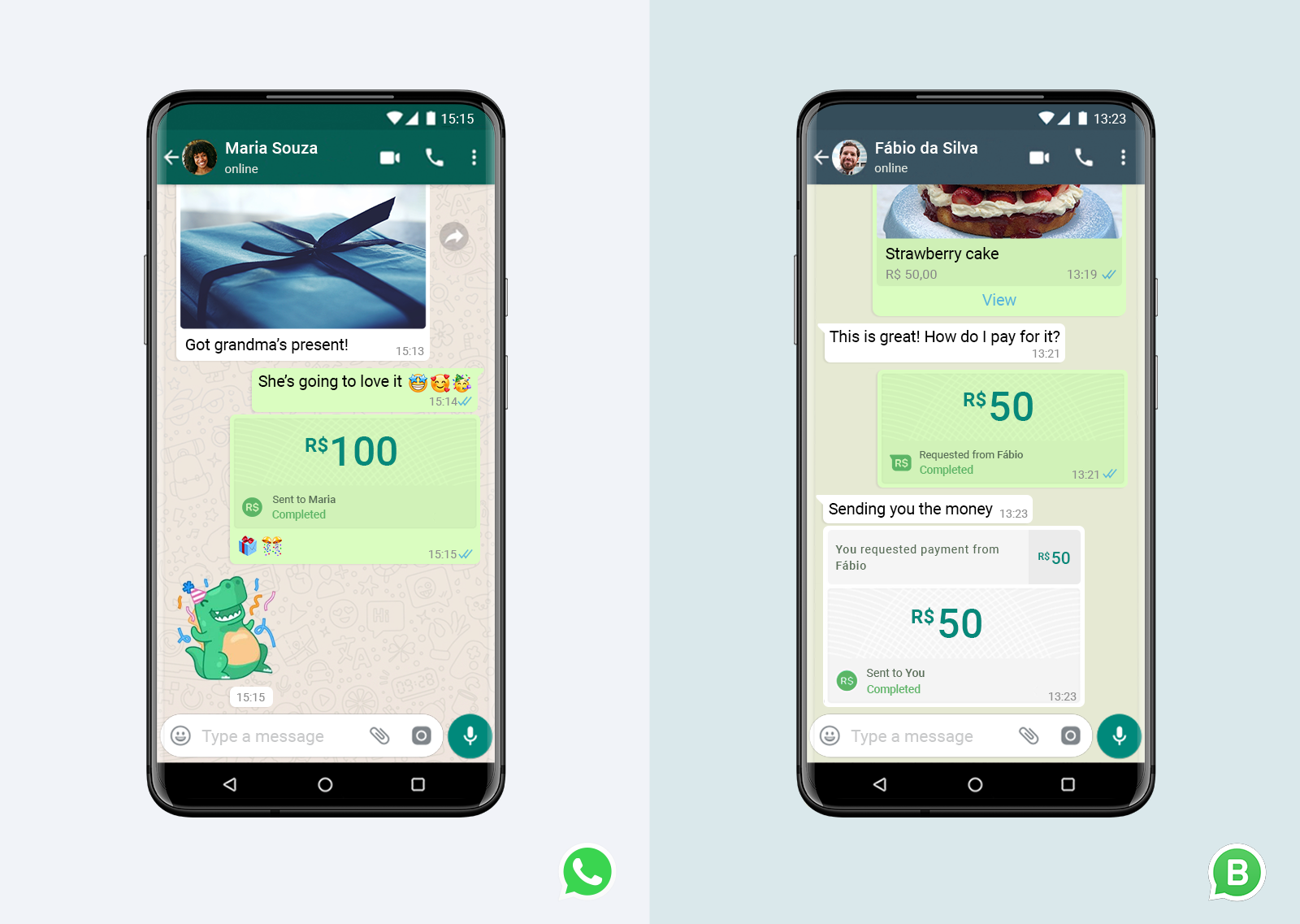

The pictorial below gives a clear picture of the simplicity of the service dubbed ‘Send money on WhatsApp just like photos’

Initially, it has to be linked to users’ Visa or MasterCard credit or debit card, which could initially restrict it to bank customers only.

The attractiveness of the service is its ubiquity in its integration with Facebook’s extremely popular platform of social media apps including Facebook, Facebook Shops, Messenger, Instagram, WhatsApp and WhatsApp Business.

The key target of the service is e-commerce like WhatsApp Business, a product that allows SMEs through the app to post product catalogs and stock links where customers can chat about a product, send payments and now transact seamlessly from their WhatsApp account.

What does it portend for Kenya market? Is Kenya attractive for WhatsApp Pay? – Yes. Recent statistics estimate the usage of instant messaging platforms at 73 percent in 2019 and WhatsApp at the top with daily usage (compared to other apps) at above 87 percent across the 16 – 45 years age bracket.

All four Facebook’s social media apps were ranked higher compared to all other forms of social media apps including Personal email, Twitter, Telegram, Snapchat, Work email and Skype. This ingrains Facebook’s ecosystem as a possible formidable challenger in the Kenyan mobile money scene through its suite of highly popular apps.

In terms of mobile money usage patterns, payments is still under-utilized (creating an opportunity) at 26 percent compared to funds transfer which is the most popular usage of mobile money at 79 percent.

On overall, Kenya’s economy is still cash-heavy; with about 90 percent of daily transactions still cash-based according to a 2019 report by the Financial Sector Deepening, a large opportunity for payment service providers.

The large opportunity coupled with the popularity of the social media platforms, one could not but wonder whether the social media giant will be an intimidating risk to the dominant M-Pesa ecosystem.

A blow to M-Pesa? Not likely

In the domestic scene, M-Pesa is a giant in its own right, facilitating transactions to the tune of satrillion (USD 40Bn) a year. Its key competitive edge against WhatsApp Pay and other upcoming money apps are its deep integration and seamlessness with the existing financial ecosystem.

In its corner, M-Pesa can count on:

• A deeply entrenched ubiquitous brand that that has outgrown its mother company, Safaricom

• A large agency network that not only facilitates M-Pesa transactions but other money and telecom services working as customer service centers

• Its ecosystem of value added services that work seamlessly from the single wallet including, lending and savings, M-Pesa ATM withdrawal services, bill payments. Growth of M-Pesa has mainly been from the ‘new business’ channels which includes KCB M-Pesa, M-Shwari and Fuliza against the traditional channels; withdrawal charges and peer-to-peer charges

• The existing interoperability, integration and relationships with business services (including banks) that allow Customer-to-Business and Business-to-Business transactions. Interoperability with the existing financial ecosystem will be critical to success of WhatsApp Pay as a challenger

• Its advantaged position if banks get skeptical to accept WhatsApp Pay since it will be a competition to their own payment platform Pesalink. Banks will also be critical to success.

• There is also possibility of regulatory skepticism of ‘digital invasion’ by the global tech giants if India’s case is anything to go by. India’s regulators have delayed approval of WhatsApp Pay for mass market despite the trials that has been running since 2018. The tech giants due to their massive power and influence could be problematic to regulate especially for small economies.

• There has been data privacy and trust concerns especially with Facebook’s ad and social media business practices’ use of personal data. With the additional and critical data from the payment service (payment account details, transaction details, etc), it is easier to see people rather stick to their ubiquitous and proven platform.

WhatsApp Pay as a risk to M-Pesa

• Global reach through its popular ecosystem of apps. WhatsApp could easily allow international transactions and given the large number of users, this could scale extremely fast across millions of its users.

• WhatsApp Pay can easily resonate with the social-media savvy young generation who are less concerned with brand loyalty.

• Due to its scale, it can succeed with zero or near-zero transaction costs. This can pressure mobile money transfer charges that form a bulk of M-Pesa revenue to the tune of Sh 28Bn (c.34% of M-Pesa revenue). With the launch, peer-to-peer transfers are free, while payments to business will be charged to the business at similar rates to those charged by Visa and MasterCard, again free for customers.

However, this is a call on M-Pesa

• A cloud-based rather than a SIM card-based M-Pesa can stand against WhatsApp Pay and other kinds of mobile/internet money. These cloud-based monies eliminates majority of restrictions to access customers unbound by geography or telephony network offering an almost immediate scalability of the service to millions of users.

• M-Pesa Global is a service that would get close to competing in the global arena due to its partnerships with global entities such as Western Union, MoneyGram, WorldRemit and PayPal and through partnerships with existing global e-commerce companies like Alibaba.

Our View

We do not see WhatsApp Pay as a big risk to M-Pesa but a wakeup call. M-Pesa will have to innovate away from the SIM card-based platform to take opportunities unbound by network or geography and give it more versatility.

Past history evidences that Safaricom is not one to sit as its market share erodes away.

The writers of this article are economic experts at Genghis Capital.