NAIROBI, Kenya, May 21 – Jubilee Holdings has posted a reduced profit of Sh4.02 billion for the 2019 financial year, down from Sh4.13 billion posted the previous year.

In a statement, the company attributed the reduction to lower insurance results of Sh2.63 billion compared to Sh2.89 billion in 2018 and a lower share of profits from investments in associates.

During the period under review, the Group posted a growth of 9.9 percent on total Gross Written Premiums and deposit administration contributions increasing to Sh38.19 billion for the year ended December 2019.

The medical business posted a growth of 8.9 percent from Sh9.94 billion to Sh10.82 billion, with underwriting profit of Sh721 million from all countries.

General business grew by 6 percent to Sh11.48 billion, however with an underwriting loss of Sh480 million.

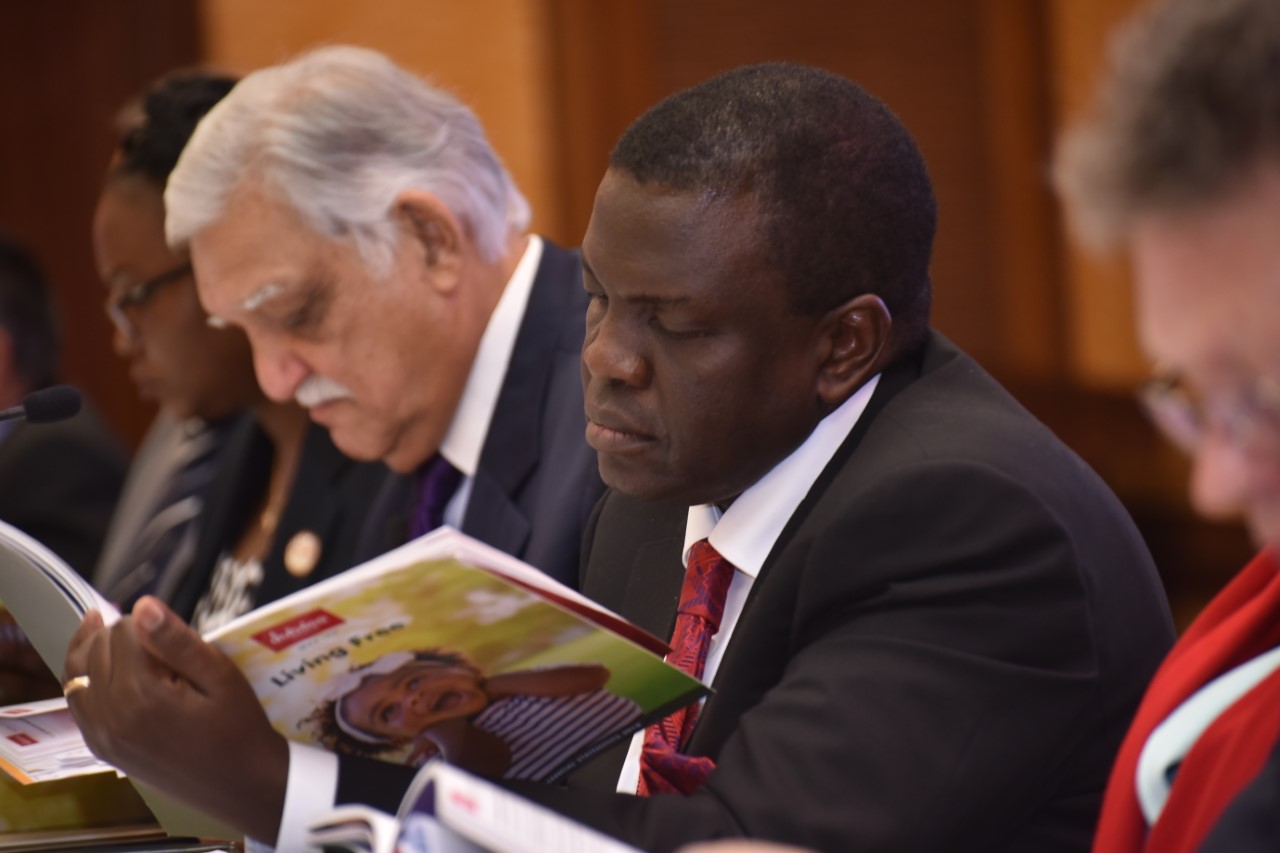

The Group’s Chairman Nizar Juma said that the underwriting loss in general business reflects the continued challenges faced by insurers in the highly competitive Kenyan market.

As a consequence, the Group made the decision to transform its Kenya business by combining technology and new business processes with existing strengths, to create a business that is well prepared to compete in an increasingly digital business environment.

The Chairman stated that “Whilst the cost of this rebuilding process has been significant, it was clearly necessary, and the Kenya General business is now well positioned for profitable growth.”

Juma further noted that the non-life insurance industry in Kenya has been going through a challenging and unsustainable phase.

This segment, which represents 57 percent of the total insurance industry gross premiums, generated an underwriting loss of Sh2.97 billion in 2019, an increase of 80 percent, compared to the loss reported in 2018; mainly due to poor claims experience in the Motor segment.

He added, “Clearly this level of loss making is not sustainable in the long run, eroding the capital of many companies within the industry and the capacity of these companies to adequately serve the insured.”

Jubilee Holdings Board has declared a final dividend of Sh8 per share, which is in addition to an interim dividend of Sh1.00 per share paid in October 2019, bringing the total dividend for the year to Sh9 per share.