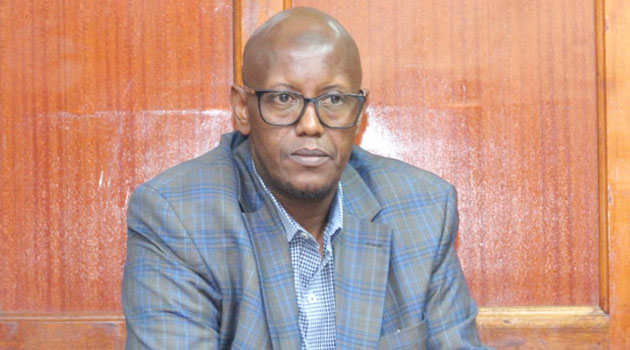

Hassan Ahmednur Baricha (pictured) appeared before Milimani Courts where he was charged with five counts of falsifying statements to lower tax liability payable to the Commissioner for Domestic Taxes as required by the Income Tax Act CAP 470, Laws of Kenya/CFM

NAIROBI, Kenya, Oct 15 – A director at Hanamal Constructions Limited has been charged with tax fraud amounting to Sh173 million.

Hassan Ahmednur Baricha appeared before Milimani Courts where he was charged with five counts of falsifying statements to lower tax liability payable to the Commissioner for Domestic Taxes as required by the Income Tax Act CAP 470, Laws of Kenya.

Kenya Revenue Authority (KRA) Commissioner for Investigation and Enforcement David Yego Monday said that Hanamal Construction Limited unlawfully made incorrect statements in Income Tax return for the year 2015 and reduced the Corporate Tax Liability by Sh4,944,163.

“Baricha is also guilty of making incorrect statements in the company’s income tax return for the year 2016 which reduced he cooperate tax liability by Sh20,817,971,” Yegon said.

“He also made incorrect statements in the Income Tax return for the year 2017 reducing the Company’s Corporate Tax Liability by Sh24,106,797,” he added.

On the fourth count, Ahmednur was accused of unlawfully made incorrect statements in the Income Tax return for the years 2015, 2016 and 2017 that reduced his Income Tax liability by Sh57,538,801.

In the fifth count, Baricha has been accused of filing incorrect statements in his Value Added Tax (VAT) returns in 2015, 2016, and 2017 thereby reducing his VAT liability by Sh65,651,535.

He, however, denied all the charges. A Nairobi court will determine his application for bail on October 15, 2019.

The prosecution was opposed to the application by the accused person arguing he is a flight risk, armed and had resisted arrest causing grievous body harm to the arresting officer.

Baricha’s prosecution comes at a time the tax agency has announced that it was pursuing Sh53 billion in tax evasion cases in the new financial year that started in July 2019.

The tax suits are currently numbering 118.

KRA announced earlier that it is targeting to prosecute 600 tax evaders in the 2019/2020 finance year.

Two directors of Olympus Computer Garage Limited were charged on Friday with ten counts of tax evasion accumulating to Sh1.4 billion

The tax collector is also targeting to collect Sh15 billion from filed cases on tax evaders in 2018/19 up from Sh8.5 billion collected 2017/2018 financial year through investigations, prosecution, and a revamped publicity strategy.