NAIROBI, Kenya, Sept 23 – In a massive boost for climate action and sustainability, leading banks and the United Nations have launched the Principles for Responsible Banking, with 130 banks collectively holding USD 47 trillion in assets, or one third of the global banking sector, signing up.

KCB Group has become one of the Founding Signatories of the Principles for Responsible Banking, committing to strategically align its business with the Sustainable Development Goals and the Paris Agreement on Climate Change.

By signing the Principles for Responsible Banking, KCB Group joins a coalition of 130 banks worldwide, representing over USD 47 trillion in assets, in committing to taking on a crucial role in helping to achieve a sustainable future.

Taking place at the start of the UN General Assembly, the official launch of the Principles for Responsible Banking marked the beginning of the most significant partnership to date between the global banking industry and the UN.

“The UN Principles for Responsible Banking are a guide for the global banking industry to respond to, drive and benefit from a sustainable development economy. The Principles create the accountability that can realize responsibility, and the ambition that can drive action.” said UN Secretary-General Antonio Guterres at the launch event, attended by the 130 Founding Signatories and over 45 of their CEOs.

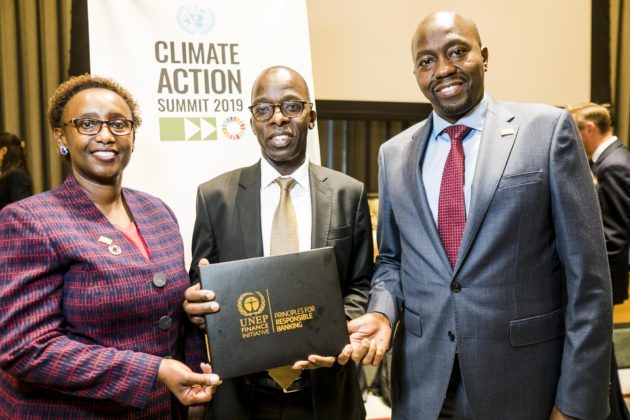

Speaking at the launch, KCB Group Chief Operating Officer, Samuel Makome said, “The official launch of Principles for Responsible Banking marks a major milestone in the global banking industry of our commitment to implement Sustainable Development Goals and Paris Climate Change into our strategic objectives. In KCB Group the Principles remind us of the reason we exist as an institution and we purpose to work with our stakeholders to shape a sustainable future for the next generation.”

“A banking industry that plans for the risks associated with climate change and other environmental challenges can not only drive the transition to low-carbon and climate-resilient economies, it can benefit from it,” said Inger Andersen, Executive Director of the United Nations Environment Programme (UNEP).

“When the financial system shifts its capital away from resource-hungry, brown investments to those that back nature as solution, everybody wins in the long-term.”

The Principles for Responsible Banking will provide KCB Group with an effective framework to systematically identify and seize new business opportunities created by the emerging sustainable development economy, while at the same time enabling the bank to effectively identify and address related risks.