Other bank profit boosters included leveraging on technology, reducing their branch network, extending operations to other countries/COURTESY

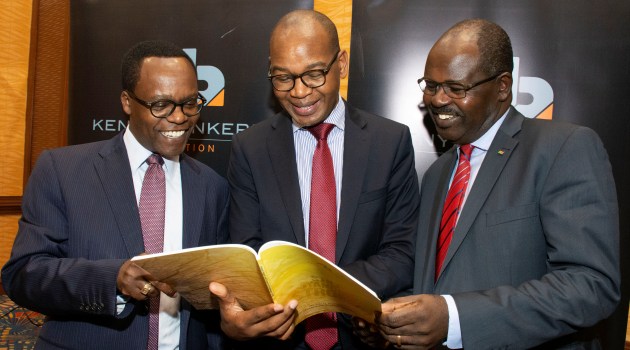

NAIROBI, Kenya, Aug 21- Kenya Bankers Association (KBA) has urged its members to focus on extending credit to Small and Medium Enterprises to boost their profits.

KBA Chief Executive Officer Habil Olaka said lending to SME’s should be a priority as it is one of the major economic drivers of growth in Kenya.

“The only alternative we have is to focus on how banks perceive the growth of SME’s by lifting the caps or finding a solution towards the caps,” he says.

Olaka linked his sentiments on increased lending to SME’s by banks terming some of the growth drivers of banks witnessed in the past week as undependable.

“Some of these profit-making areas such as lending to the government, will not be sustainable as it will reach a point where the government will be able to manage its fiscal deficit,” he adds.

According to KBA, other bank profit boosters included leveraging on technology, reducing their branch network, extending operations to other countries, among others.

Majority of the bank in the past week have released their half financial year results, for the year ending June 2019.

Some of the banks include Equity Bank, where its half-year net profit increased 9 percent to Sh12 billion with its loans to the treasury increasing by 13 percent to Sh179.6 billion in the period.

KCB Group announced a five percent growth in earnings for the first six months of the year to Sh12.7 billion and pumped up an additional Sh22.4 billion to the Treasury to represent a significant 20 percent jump in portfolio’s investment.

NIC Group which is in the process of merging with Commercial Bank of Africa is now the latest bank to announce its half-year results recording an increase of 4 percent in profit before tax of Sh2.96 billion.

Late May 2019, Central Bank of Kenya partnered with five local banks to introduce a product called Stawi that will see banks increase its lending to SME’s.

The product will see customers offered unsecured loans ranging from Sh30,000 up to Sh250,000 with repayment profiles of 1-12 months, at an interest of nine percent per annum.

CBK governor Patrick Njoroge said the product will revolutionize the financing of micro, small and medium scale enterprises in Kenya.

“The mobile-based credit scheme is set to improve access to credit for small-to-midsize enterprises, which have been locked out of the formal credit market because of the informal nature of their records and lack of collateral for secured loans,’’ Njoroge said.

The loans are managed by the Cooperative Bank of Kenya Limited, Diamond Trust Bank Kenya Limited (DTB), KCB Bank (Kenya) Limited, and NIC Group Plc.