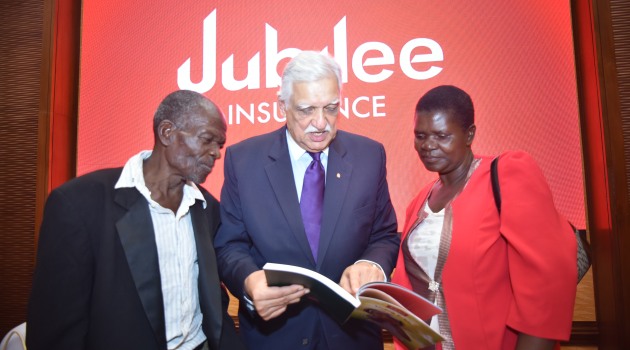

Despite operating in an extremely challenging environment, JHL was able to record growth in Gross Written Premiums, insurance results and PBT for the year ending December 31st, 2018/Courtesy

NAIROBI, Kenya, Jun 25 – Jubilee Holdings Limited has launched three new insurance products aimed at increasing insurance penetration in the region.

The strategy is inspired by the desire to take leadership in addressing the diverse insurance needs of the citizens of East Africa across the full spectrum of demographics and local needs to develop more regular engagement through unique value propositions that deliver enhanced customer experiences.

Jubilee Insurance Regional Chief Executive Officer Julius Kipng’etich said the new development provides a new and wider range of products, health management apps, customer care packages and distribution options that will increase accessibility for all their clients.

“In this direction, Jubilee Insurance in Kenya has recently introduced several new medical insurance products including J-Senior for individuals over the age of 60, J-Inue for lower and middle income families and Msafiri, that provides immediate hospital care in the event of an accident for bus travelers at a cost of Sh25 per trip,” he said.

In addition, the launch of “Recover in Style” which provides hair and make-up services to Jubilee patients who are hospitalized and home insurance under Home Fibre is aimed at taking care of JHL customers and providing services that go beyond the financial needs and into the realm of delivering superior customer experiences.

“What we are creating is a path of product innovation that involves embedding a range of value-added services within the insurance product, thereby enabling us to become true partners that go beyond providing financial assistance to our customers,” noted the Jubilee Insurance Regional CEO, Julius Kipng’etich.

Despite operating in an extremely challenging environment, Jubilee Holdings Limited was able to record growth in Gross Written Premiums (GWP), insurance results and Profit before Tax for the year ending December 31st, 2018. The overall growth with profit, including Deposit Administration contributions, increased to Sh34.8 billion from Sh33.8 billion in 2017 whilst pre-tax profit increased 4.8% to Sh5.41 billion from Sh5.16 billion in 2017.

This was supported by a strong contribution from insurance results at Sh2.9 billion from Sh2.7 billion in 2017.

Official data indicates that 19 out of 40 Insurance Companies made losses and the industry, including Jubilee which made a profit of 4 billion.

The Group’s total assets increased by 9% to Sh114 billion from Sh105 billion and total shareholders’ equity and reserves increased 11% from Sh23.6 billion to Sh26.1 billion.

The company maintained its regional market leadership in medical business and posted a growth of 4% from Sh 9.5 billion to Sh9.9 billion, with underwriting profit of Sh753 million.

During the year, the Boards of JHL and Jubilee Insurance Kenya approved the split of the Kenya subsidiary into three separate companies specializing in Medical, General and Life businesses respectively.

The Insurance Regulatory Authority has encouraged the operation of short-term and long-term companies as separate entities as a matter of public interest.

Jubilee Holdings Board has declared a final dividend of Sh8.00 per share for a combined interim and final dividend of Sh9.00 per share.