San Francisco, US, Apr 9 – Branch has announced a new global partnership and investment from Visa of $170 million (Sh1.7 billion) which will help expand financial access across the African continent, while fueling new expansion in India and Latin America.

The Series C financing round, led by Foundation Capital and Visa, joins existing investors, Andreessen Horowitz, Trinity Ventures, Formation 8, the IFC, CreditEase, and Victory Park as well as new investors, Greenspring, Foxhaven, and B Capital.

“I’ve known the Branch team since right after the company was founded,” said Charles Moldow of Foundation Capital, who will be joining the Branch Board of Directors. “After tracking them for years, it has become clear to me that emerging markets are one of the biggest growth areas for fintech.

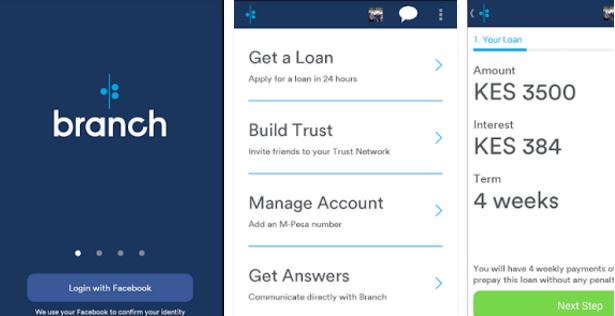

Branch and Visa will team up to offer virtual prepaid debit card numbers to customers around the world. This enables unbanked Branch customers the option to receive credit at any physical ATM, bypassing the need for a bank account.

“We started Branch in Kenya, where M-Pesa gives anyone with a phone, including the unbanked, access to digital credit. Unfortunately, mobile money isn’t available in most countries. With the help of Visa, now we can send cash to any ATM and reach the underserved around the planet,” says Matthew Flannery, CEO and co-founder of Branch.

Visa Executive Vice President of Strategy, Bill Sheedy, said the partnership provides Visa with a key distribution mechanism to reach people that were previously out of reach and help shape the future of microfinance.

Traditional barriers such as a credit score and bank account make financial accessibility a challenge for over 2 billion people in the world.

Yet many in underserved markets have a financial tool right in their pocket – their mobile phone. By tapping into the rise of mobile technology worldwide, Branch aims to radically expand financial access, making full global inclusion a reality in our lifetime.