NAIROBI, Kenya, Oct 10 – Unlicensed insurance agents are negatively affecting the sector amid a negative growth in insurance penetration and a decline of profit margins.

Bima Intermediaries Association of Kenya Chairman Washington Ndegea says there is an alarming increase of rogue agents who are now between 2500 to 3000 agents.

Ndegea says insurance companies are exacerbating the situation as they continue to take premiums and give commissions to unlicensed agents.

“These agents continue to spoil our name despite our resolve to increase insurance penetration in the country; we have seen instances where insurance companies are giving touts commissions for taking businesses of their buses to them. This is unprofessional and killing the Insurance business,” Ndegea said.

Licensed insurance Agents have grown from 4,862 in 2012 to about 7,720 in 2016.

In 2016 Insurance Regulatory Authority (IRA) received 1,080 complaints against registered insurance companies in 2016, an increase from 620 complaints received in 2015.

The complaints related to the delayed settlement of claims, underpayment of claims, declined claims and mis-selling of insurance products.

“These complaints are linked to rogue insurance agents who must be weeded out,” Ndegea noted.

Out of the total complaints received, 60 percent were against general insurers while 40 percent were against long-term insurers according to the IRA 2016 report.

During the year, 70 percent of these complaints were resolved.

Currently, insurance penetration in Kenya stands at 2.73 per cent, which is considered low compared with the world average of 6.28 per cent.

However, in the wider East African region, Kenya accounts for 70 per cent of all insurance products bought.

Insurance in Kenya is mainly sourced through agents, brokers or directly by insurance companies with agents taking the lead by 46.3 percent.

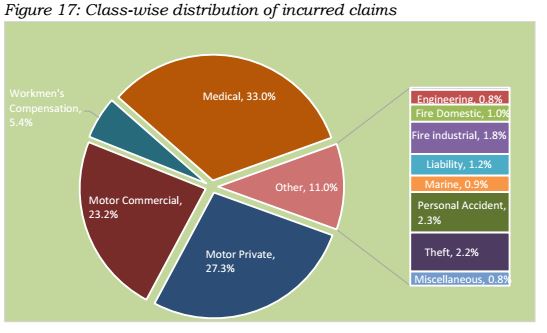

In 2016, general insurance business underwriters incurred claims amounting to Sh54.86 billion, an increase of 11.8 percent from Sh49.05 billion incurred in 2015.

The general insurance business classes with the highest premium income incurred larger proportions of claims with medical incurring 33 per cent of the total claims while motor classes of business incurred 50.5 per cent of the total claims.

The general insurance segment in Kenya recorded loss ratios ranging between 58.4 per cent and 62.7 per cent during the last five years, against a global benchmark range of 50 percent – 70 per cent.

Aviation, medical and motor private classes are the only classes that recorded loss ratios exceeding this global benchmark at 158.2 per cent, 75 per cent and 75.8 per cent respectively in 2016.

IRA in 2013 launched the Executive Certificate of Proficiency (ECOP) in Insurance in a bid to expand the agency force in the country.

Since its inception, IRA has trained over 1000 individuals in 29 counties.

Ndegea was speaking during the launch of Agency Choice Awards set for November 3, 2017.