The survey also reveals that thirty-one percent of women are borrowing to start or complete a construction project compared to 26 percent men/FILE

NAIROBI, Kenya, Mar 23 – Kenyan men are borrowing money from banks to finance their business operations while women are taking loans for education purposes.

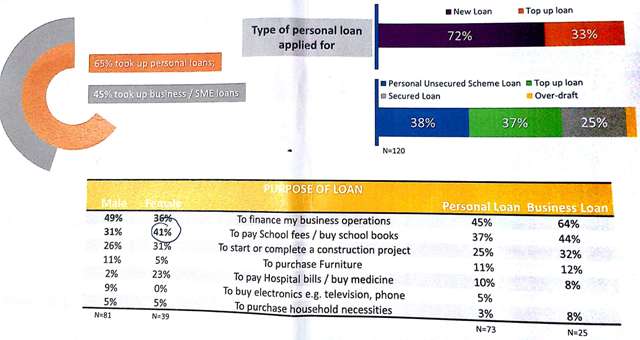

This is according to a study by the Kenya Bankers Association (KBA) which reveals that 49 percent of men borrow for business financing compared to 36 percent females who do the same.

On the other hand, 41 percent of women are taking loans to pay school fees and buy books, compared to men at 31 percent.

“For those who borrowed money, majority applied for personal loans with the aim of funding their business operations especially men, while women borrowed more for education and to complete construction projects,” the study shows.

Thirty-one percent of women are borrowing to start or complete a construction project compared to 26 percent men.

The Consumer Survey – Banking Amendment Act-2016, was commissioned by being undertaken to check the impact of the new interest cap law which took effect in September 2016.

Eleven percent of men are taking loans to purchase furniture compared to 5 percent women. Five percent of men are also taking loans to buy electronics.

The KBA study comes after a recent study by Graça Machel Trust and New Faces News Voices which also indicated women are shying away from taking commercial loans to finance business.

READ: 7 in 10 East African women avoid loans to finance business, study finds

The study reveals that a majority of women are still not ready to access formal financing due to lack of collateral as well as high-interest rates.

Internationally, banks rushed for a final round of cheap long-term loans from the European Central Bank, the Frankfurt institution said today, as signs mount that the cost of money may soon rise.

Some 474 banks borrowed a total of 233.5 billion euros almost a fourfold increase compared with the 62.2 billion lent out by the ECB at the last round in December.

Launched in 2015, the ECB last March extended its quarterly Targeted Long-Term Refinancing Operations (TLTRO) scheme for an extra year.

Banks have been able to borrow at zero interest in a programme designed to persuade them to lend the cash on to companies and households in the real economy.

Across the pond, the Federal Reserve in the United States has already begun raising benchmark interest rates and hinting at further hikes to come.