These companies include Uchumi Supermarkets, Mumias Sugar, Kenya Airways, National Bank Kenya and TransCentury/FILE

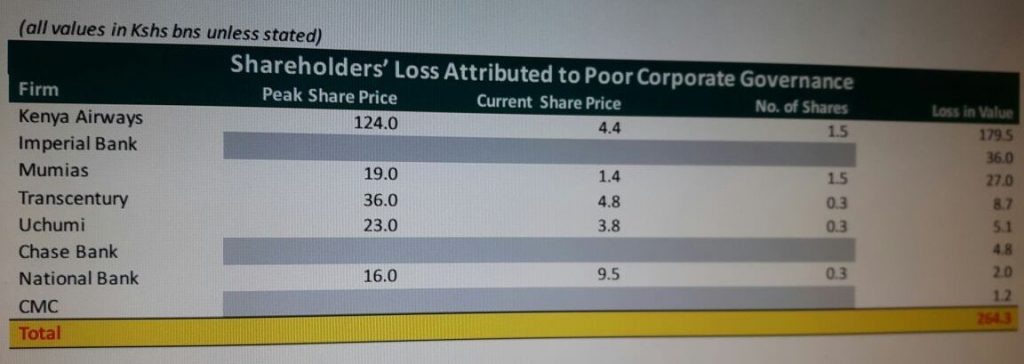

NAIROBI, Kenya, May 9 – Poor corporate governance has robbed listed firms’ investors of Sh264 billion in the recent past, according to a new report by Cytonn Investments.

The report which is the first corporate governance report in Kenya indicates that about 13 percent of listed firms have significant corporate governance issues, which is a worrying trend.

These companies include Uchumi Supermarkets, Mumias Sugar, Kenya Airways, National Bank Kenya and TransCentury.

“That is a worryingly high statistic that should call into question our regulatory frameworks and their effectiveness,” said Elizabeth Nkukuu Chief Investment Officer Cytonn Investments.

The corporate governance concerns have been largest in the banking sector, with shortfalls leading to the closure of three banks.

All the cases, including those which have mismanagement, can be related to fraud, lack of board supervision, non-disclosures and no transparency to the investing public.

“Other than disclosures, we have witnessed several cases of restatement of earnings by large financial services firms, bringing into question the quality of earnings and reliability of information,” Nkukuu explained.

These issues have centred around Chief Executives and Directors, who should be at the forefront of protecting shareholder rights.

The issues also raise alarm on the level of supervision by regulators, according to the report.

“In the case of Imperial Bank, the decision to accept money for a corporate bond and approve listing by Capital Markets Authority and Nairobi Securities Exchange, only weeks before the bank was closed, raises questions over the diligence of review as investors lost a total of Sh2billion in the bond issue,” the report states.

The issues Nkukuu says have negative effects on investor confidence and market sentiment, especially for banks in Kenya.

In the banking sector, measures had to be taken by the Central Bank of Kenya (CBK) to provide liquidity to smaller banks and restore confidence.

According to the report, sophisticated investors are now looking beyond valuation using financial ratios, and questioning the level of governance and professional ethics within any organization.

“CBK has already come out in to the market to state that the level of supervision needs to be greater, and the Governor will lead the effort Given CBK has already acknowledged that supervision could be stronger, are Insurance Regulatory Authority and CMA sufficiently covering their sectors under supervision to prevent further investor losses?,” She asked.

On the other hand, KCB Group, Safaricom and Standard Chartered Bank emerged top in terms of best practices in corporate governance amongst the 50 listed companies at the NSE that have a market capitalization exceeding Sh1 billion.

The top three bottom on the list include Kenya Orchard, Limuru Tea and Flame Tree Group at 10 percent, 18.3 percent 33.3 percent respectively.

The report, which shall be released once every year, ranks listed firms using 24 metrics.

The metrics include disclosures, board composition and attendance, gender diversity, ethnic diversity, transparency and independence.

“Good corporate governance and sound professional ethics are essential to well-functioning markets, which in turn protect the interest of the investing public. As our markets expand, and firms become more exposed to the public, corporate governance is key to ensuring vibrancy, reducing investor losses and providing a platform for a firm and the economy to grow in a sustainable manner” said Maurice Oduor, Cytonn’s Head of Investments for Public Markets.

“Corporate governance is founded on the pillars that businesses have to practice accountability to stakeholders, disclose information, have transparency in business activities and exhibit independence in decision making of the board,” added Oduor.