This follows consultations within the government that agreed to extend the period that KPRL needs to become a ‘merchant’ refinery to July 1, 2012.

“This extension is to allow for the publication of the necessary legal notices by concerned government institutions after which KPRL shall proceed to arrange the funding for the expected crude oil importation,” said a statement from Prime Minister Raila Odinga’s office.

This is because once the conversion is effected, the refinery will participate in the tenders to import crude oil alongside other marketing companies.

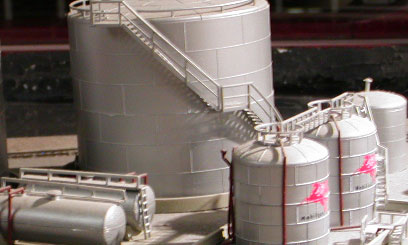

The Mombasa-based refinery was initially scheduled to migrate from the current system where it processes petroleum products imported by oil firms at a fee to the proposed arrangement on January 1 this year.

Later, this date was pushed to April this year but there have been hurdles in making these changes.

The plan to transform KPRL from a processing refinery into a merchant one was mooted in May 2011 after the inconveniencies caused by the structural inefficiencies and power outages at the plant become too much to bear.

The facility which is meant to supply 40 percent of super petrol consumed in Kenya has on several occasions been unable to meet the country’s demand leading to shortages of products in the country.

Last upgraded in 1994, the factory’s full production capacity is six million metric tonnes.

These challenges have in turn translated into higher pump prices for Kenyans as the inefficiency costs are borne by the marketers who then pass on the costs to the consumers.

It is estimated that these inadequacies add about 20 percent to the cost of a litre of any petroleum product that is processed at KPRL.

With this new arrangement however, the government anticipates that the refinery will absorb the inefficiency costs which will in turn translate into reduced pump prices for consumers.

In a bid to cushion itself and ensure that it runs a profitable business, KPRL has in the past proposed several measures such as the levying of a 6.88 percent fee of the import parity prices to be included in the price of refined fuel.

Further, the refinery wants to be given the leeway to select crude oil to be processed.

The government has however remained mum on whether it will grant these wishes to KPRL although this should become increasingly clear when the launch date approaches.