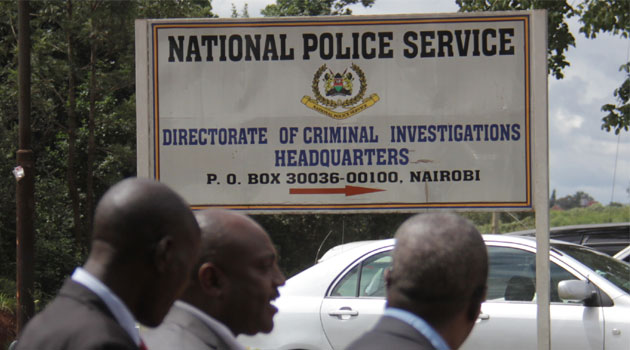

The four arrived accompanied by their lawyers during the more than four hours of interrogation, according to a senior detective privy to the ongoing investigations/MIKE KARIUKI NAIROBI, Kenya, Apr 11 - Suspended National Bank of Kenya Chief Executive Officer Munir Ahmed and three other officials of the institution were on Monday grilled by detectives at the CID headquarters in the ongoing investigations into financial irregularities at the bank.

The four arrived accompanied by their lawyers during the more than four hours of interrogation, according to a senior detective privy to the ongoing investigations.

"They have been at the CID headquarters since 11am," he told Capital FM News.

Police at the weekend questioned two former Chase Bank officials after the bank was put under receivership following orders by Inspector General of Police Joseph Boinnet.

"Following the announcement by the Governor of Central Bank of Kenya regarding unethical conduct by certain bank directors and managers, I have therefore ordered the immediate arrest of the following persons, or in lieu, they must present themselves to the Directorate of Criminal Investigations along Kiambu road before 3.30pm today (Friday)," the IG had directed.

The warrant of arrest was issued a day after CBK appointed Kenya Deposit Insurance Corporation (KDIC) as receiver of Chase Bank following revelations of financial malpractice.

NBK board of directors has since suspended all the six managers being probed pending an independent internal audit.

Police also arrested David Mukunzi Zawadi for 'misusing social media to disseminate falsehoods about the banking sector.'

"Some unscrupulous members of the public have taken to social media to spread unfounded rumours and conjecture aimed at causing unnecessary fear and panic…we accordingly wish to caution members of the public to be wary of such messages and refrain from disseminating the same." Central Bank of Kenya (CBK) has also set aside a facility to cushion banks experiencing liquidity pressure in aim to restore depositors' confidence.

CBK Governor Patrick Njoroge said they are hoping to deal with fear and anxiety that are making depositors act in an irrational way that bring down institutions that are otherwise solvent.

"From Monday, we will avail a facility to any financial bank or micro finance institution that comes under liquidity pressures arising from no fault of their own. We will avail it facility for as long as necessary to return stability and confidence to the Kenyans financial sector," Njoroge explained.

"In terms of the amounts, it will be sufficient for the institutions to stand. We don't have an upper or lower limit," said the CBK boss when asked about the sum of the facility.

The banking sector regulator emphasized that he has confidence in rigor and strength of the sector and will continue to monitor and oversee full compliance of the existing regulations.

About The Author

Hi, what are you looking for?

top