NAIROBI, Kenya, Jul 4 – Insurance premiums have continued to rise while commissions decrease in Kenya’s insurance sector.

In the first quarter of 2017 Insurance premiums hit Sh67.2 billion representing a 14.4 percent growth according to the latest statistics from the Insurance Regulatory Authority (IRA).

This was an accelerated growth compared to the 9.6 percent growth witnessed in the first quarter of 2016.

However net spending on commissions for the period under review was Sh2.92 billion, representing a decline of 6.6 percent from Sh3.12 billion reported in the first quarter of the previous year.

“Commissions and management expense ratios under general insurance business were 7 percent and 30 percent respectively resulting in a combined ratio of 102 percent,” the report states.

Bima Intermediaries Association of Kenya(BIAK) Chairman Washington Ndegea, attributes this decline to direct business to the insurance companies, increased failure by insurance companies in paying commissions as well as more premiums being recovered from clients who had insurance on credit.

“Agents are owed commissions by insurance companies, and this has resulted in intense meetings between the companies and agents’ association. The major thorn in this issue is life insurance companies terminating agents for one flimsy reason or another and refusing to pay them commissions.”

“This is also the main reason insurance agents are leaving the insurance industry in droves, despite IRA carrying out training missions in a bid to increase the numbers. The issue lies squarely with insurance companies,” Ndegea told Capital FM Business.

The growth of the premiums was largely driven by the long-term segment which grew by 24.8 percent compared to a 9.6 percent growth in the general insurance business segment.

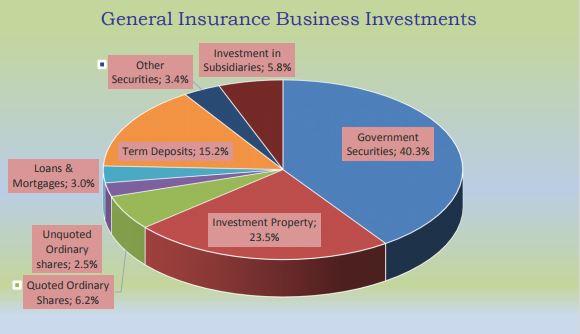

Latest statistics indicate that the general insurance business segment contributed 65.7 percent at Sh41.56 billion while long-term insurance business contributed 34.3 percent to Sh21.65 billion of the total premium written by insurers during the period under review.

Reinsurers’ premiums income stood at Sh4.01 billion in the period under review representing a growth of 24.4 percent from the Sh3.22 billion reported by the end of March 2016.

The gross premium income reported under life reinsurance business amounted to Sh607.81 million while that under general reinsurance business was Sh3.40 billion.

The loss ratio under general insurance for the period under review was 65 percent while claims incurred by general insurers hit Sh14.60 billion in the first quarter of 2017, an increase of 5.2 percent compared to Sh13.87 billion incurred during the previous year.