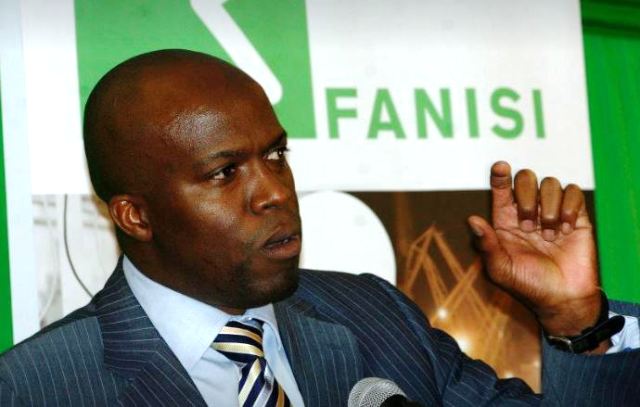

“We got eight local pension funds investing in this round, which is a big move for us as Fanisi and even the industry, as a whole,” Ayisi Makatiani

NAIROBI, Kenya, Jun 14 – Private Equity firm Fanisi Capital has secured commitments worth Sh3 billion that is part of an SME venture fund targeting to raise Sh10 billion in 12 months.

45 percent of Sh3 billion has been committed by local investors including SACCOs and Trust Funds, with the rest coming from various international investors.

According to Managing Partner and CEO Ayisi Makatiani, the fund will be directed to four key high growth sectors that include healthcare, retail and wholesale, education and agri-business,

“We got eight local pension funds investing in this round, which is a big move for us as Fanisi and even the industry, as a whole. As a Kenyan-based private equity firm, it is a great milestone for us to launch a second fund, and more so to raise what we have so far, and the support we have received. We are optimistic about the market and growth in our industry,” he said.

The firm’s first fund was worth Sh5 billion and was invested in various businesses that include Haltons Pharmacy, Hillcrest International Schools and Ngare Narok Meat Industries among others.

The Fund focuses on a segment of the market that has to date been outside the ambit of most venture capital funds in the East African market.