Managing Director Jadiah Mwarania said the firm anticipates great success and growth especially tapping the new Zambia Government trade strategy for local and international investment.

NAIROBI, Kenya, Nov 3 – Kenya Reinsurance Corporation is set to enter the Southern African region through the launch of its Zambia Regional office.

The new regional hub will be based in Lusaka City and will serve Namibia, Zambia, Zimbabwe, Botswana, Mozambique, Lesotho, Swaziland Malawi and Angola.

Through this, Kenya Re seeks to ultimately increase reinsurance capacity for insurance companies in Africa.

The firms’ Managing Director Jadiah Mwarania said the firm anticipates great success and growth especially tapping the new Zambia Government trade strategy for local and international investment.

In his inaugural speech the new president of Zambia Edgar Chagwa called for economic diversification through progressive commercial diplomacy that attracts foreign and local trade investment.

Zambia has previously held a mono economy mostly reliant in copper mining.

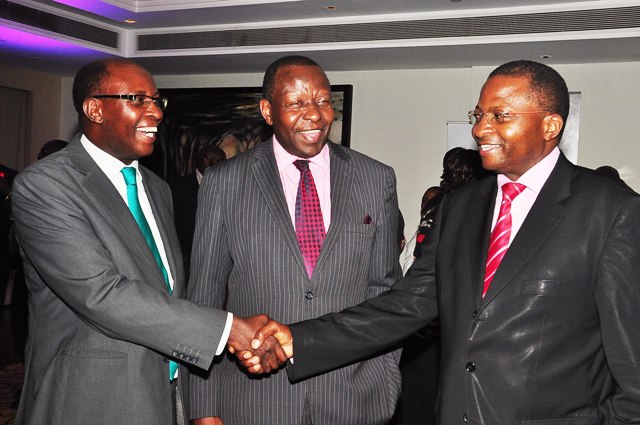

“We are pleased to launch our Zambia regional hub in the hope of expanding our existing and new business opportunities within the Southern African region. Our success will be premised on our expertise and market knowledge amplified by the outstanding human resource capacities,” Mwarania commented.

The official launch of the Kenya Re Zambia Regional office is set for November 11, 2016 at the Intercontinental Hotel in Lusaka, Zambia.

Kenya Re recently posted Sh2.1 billion in the pretax profits for the 2016 half year financial results attributing to expanding the reinsurance business locally and internationally.

The insurance industry grew moderately in 2015 with premium income slowing down slightly in both advanced and emerging economies.

Global life insurance premiums grew by 3.3 per cent in real terms in 2015 lower than 2014, 4.7 per cent growth.

Non-life insurance premiums grew by 2.5 per cent in real terms in 2015 lower than the 2014, 2.8 per cent.

Non-life insurance premium growth in emerging economies slowed down notably, reflecting weaker economic growth.

Major economies in Africa developed unevenly, also driven largely by political developments and lower oil and commodity prices.

Growth in South Africa was sluggish while Nigeria and Angola suffered from low oil prices and infrastructure bottlenecks. Oil-importing countries grew solidly (e.g. Morocco, Kenya and Cote d’Ivoire).

Life insurance premium growth in Africa slowed to 2.8 per cent in 2015 from 5.1 per cent in 2014.