CEO James Mwangi revealed that on average, 40 per cent of the applicants qualify to get the loans, with three-quarters of the applicants coming from the SME sector.

NAIROBI, Kenya, Nov 3 – Equity Group’s mobile platform Equitel has captured 15.2 per cent of the total mobile money transfer market, boosting the group’s profits to Sh15 billion for the year ending September 2016.

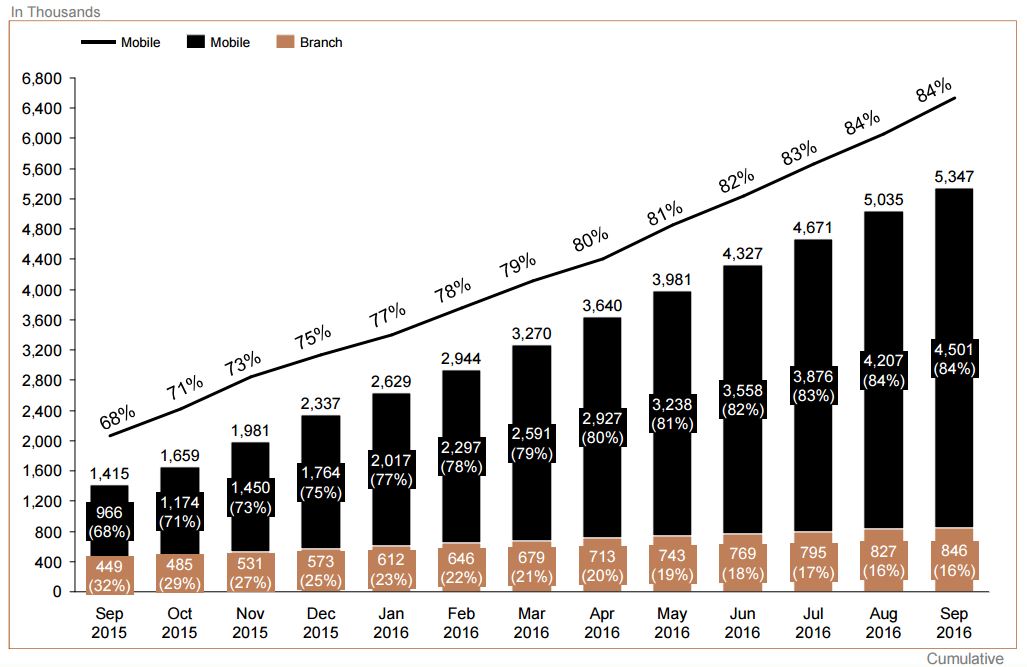

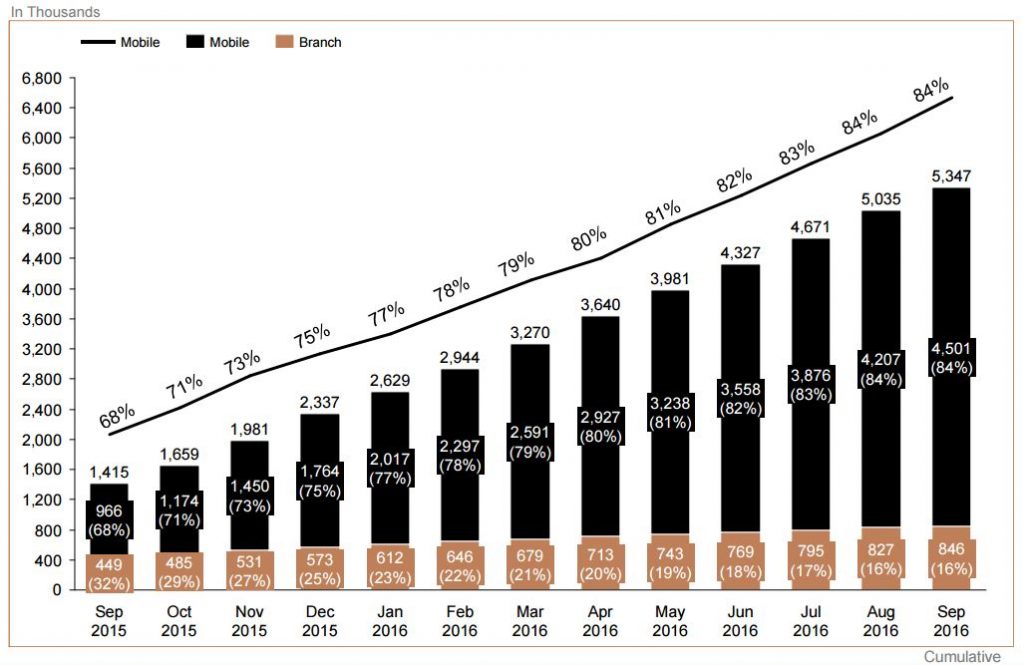

Equitel grew mobile transactions by 142 per cent to reach 150. 8 million transactions in one year handling more transactions processed by branches ATMs and agencies combined.

200 Equity branches issued 400,000 loans compared to 3.5 million loans issued on mobile platform worth Sh30 billion.

Equity Group Managing Director James Mwangi revealed the bank gets an average of 50,000 loan requests per day with the number peaking to 120,000 requests on weekends, especially Sundays.

Mwangi revealed, during the announcement of Q3 results that on average, 40 per cent of the applicants qualify to get the loans, with three-quarters of the applicants coming from the SME sector.

“This growth has been possible because we offer this service (transfering money from Equitel to Equitel or to an account) for free. we are very optimistic that by the end of the coming year, we will have captured 30 percent of the market share,” said Mwangi.

Interestingly, loans issued via the mobile platform had a 98 per cent loan repayment rate.

The group said it expects mobile-based transactions to increase as the bank migrates additional services onto its mobile platform.

According to the April to June 2016 Communications Authority of Kenya (CA) Equitel value of transactions hit Sh138 billion compared to Safaricom MPESA’s 807 billion and Airtel money’s Sh10.8 billion.

Analysts predict banks will close branches and pursue a digital strategy raising fears of downsizing staff.

READ: Kenyan Banks turn to digital banking amidst layoffs

According to Standard Investment Bank Research, banks are looking at thinner margins following the passing of the Banking Amendment Bill, forcing financial institutions to pursue a technology driven strategy to lower costs.

“Presently, Equity Bank has enacted a freeze on opening new branches and is instead using its mobile-based platforms as well as agencies to recruit new clients. Other lenders such as Sidian Bank and Family Bank are planning to cut staff in order to reduce cost of operation,” states an analyst at SIB.

Mwangi, however, said the bank has no plans of retrenching staff as branches are still relevant for SME banking because of relationship banking and corporate banking.

“We see an opportunity to even increase the number of staff because we need to serve the 11 million customers,” added Mwangi.

A recent World Bank report on Kenya dubbed Beyond Resilience, banks’ average net interest margins are likely to decline by up to 430 basis points from the 11.4 percent they averaged in June 2016.

This will impact all categories of Kenyan banks. However, given lower profit margins among Tier 3 banks relative to Tier 1 banks, they are likely to be hit the hardest.

The telco now has 2.5 million users with 94 per cent of them linking SIM card to their accounts.