RBA Chief Executive Edward Odundo says the percentage of admissions for people over 65 years currently stands at 34 per cent compared to 25 per cent a decade ago/CFM NEWS

NAIROBI, Kenya, Oct 6 – Kenya’s Health care expenditure hit Sh73.2 billion in 2015 according to Retirement Benefits Authority (RBA).

RBA Chief Executive Edward Odundo says the percentage of admissions for people over 65 years currently stands at 34 per cent compared to 25 per cent a decade ago.

Odundo says medical bills are the major key expense items that are most challenging for retirees living on a lower income.

He says the amendment of the law in the 2016/,2017 budget to allow workers to start saving for their medical insurance before retiring should see social security funds come up with such products that will help people save up for their post retirement medical fees.

“You will agree with me that employers give medical insurance to their employees through group medical schemes. On retirement, employees cease to receive benefits from their employers’ medical schemes. This sudden withdrawal of medical benefits enjoyed by employees can be stressful because they now have to bear on their own the full cost of their medical bills,” Odundo said.

He says lack of adequate healthcare is known to cause retirees early death.

It is estimated that five per cent of the population is above the age of 60 years and projected to hit the 10 per cent by year 2030.

The increase poses a challenge poses a challenge in health care for this segment of the population.

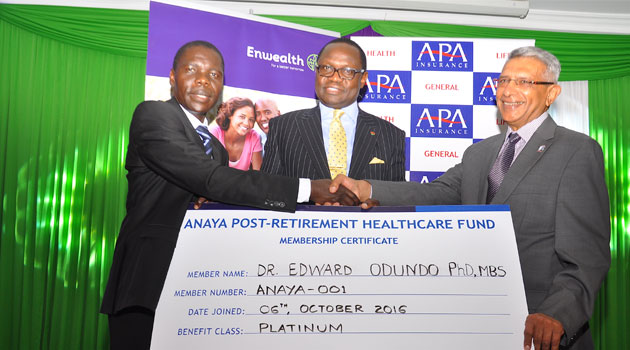

He was speaking this morning during the launch of Anaya Post Retirement Health Care Fund by Enwealth Financial Services in partnership with APA Insurance and Apollo Asset Management that allows workers to pre fund their health care insurance for use upon retirement.

With contributions as low as Sh2,000 per month, the fund members will have access to quality healthcare services from over 200 hospitals locally and abroad for high risk and chronic, pre-existing conditions including Cancer, High Blood Pressure and Diabetes which are currently shunned by traditional medical insurance covers or attract higher premiums.

“Anaya Post-Retirement Health Care Fund is the best option for workers in the market currently as it attracts much better return, guaranteeing growth for a workers’ hard earned income and at the same time cushioning them from a future filled with high medical bills,” Enwealth CEO, Simon Wafubwa.