With this new capability, customers will be able to log onto their accounts by identifying their individual fingerprints through the Touch ID on iOS devices/CFM NEWS

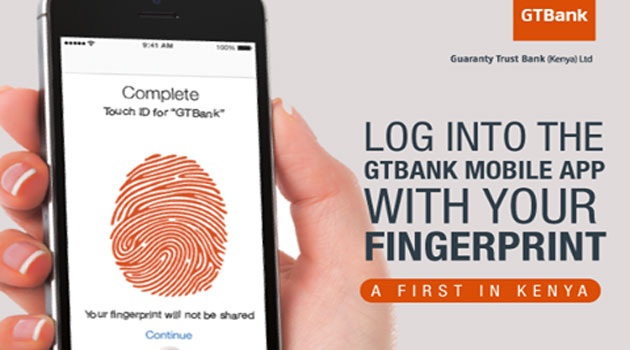

NAIROBI, Kenya, May 24- Guaranty Trust Bank Kenya has launched an upgraded version of the bank’s mobile app introducing fingerprint recognition, a first in the market.

With this new capability, customers will be able to log onto their accounts by identifying their individual fingerprints through the Touch ID on iOS devices.

The introduction of the fingerprint recognition brings added security on the mobile banking platform. The enhanced security measure comes at a time when more people are choosing to bank on their mobile phones and security of the platforms is critical.

“At Guaranty Trust Bank, we are driven by the desire to continue enhancing our customer experience at every touch point. Security in the era of mobile and digital banking is absolutely critical. The fingerprint recognition on the new GTBank mobile App gives our customers the control and confidence to transact securely on the platform,” GTBank Managing Director Ibukun Odegbaike said.

At the same time, the Bank has introduced card services on the upgraded App.

Customers will now be able to access all card services including check card balances, pay and top-up cards, stop card payments and generate card statements.

“Our investments in a state-of-the-art banking platform one year ago enabled us to roll out our cards business in partnership with MasterCard. We have taken this a notch higher and added card management capability on our upgraded mobile App,” said Ibukun.

It has revolutionized digital and social banking with cutting edge solutions that have changed the way customer experience banking on the digital and social media platforms in all the markets where it operates.