What is a Sovereign Bond (Euro Bond)?

A debt security issued by a national government within a given country and denominated in a foreign currency. The foreign currency used will most likely be a hard currency, and may represent significantly more risk to the bondholder (Source: Investopedia)

When was the Euro Bond money raised?

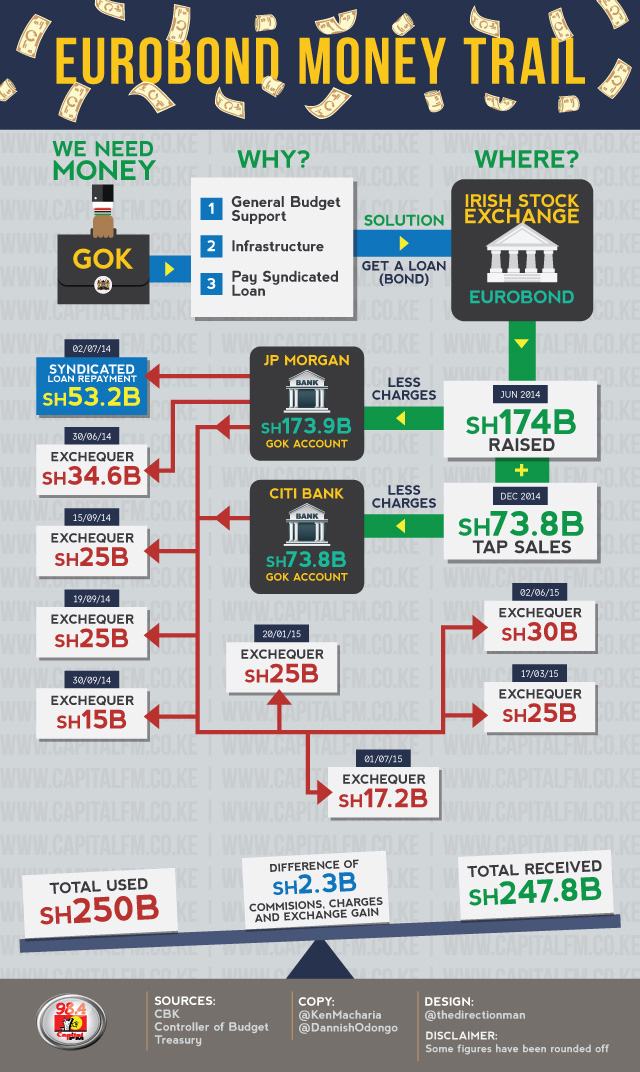

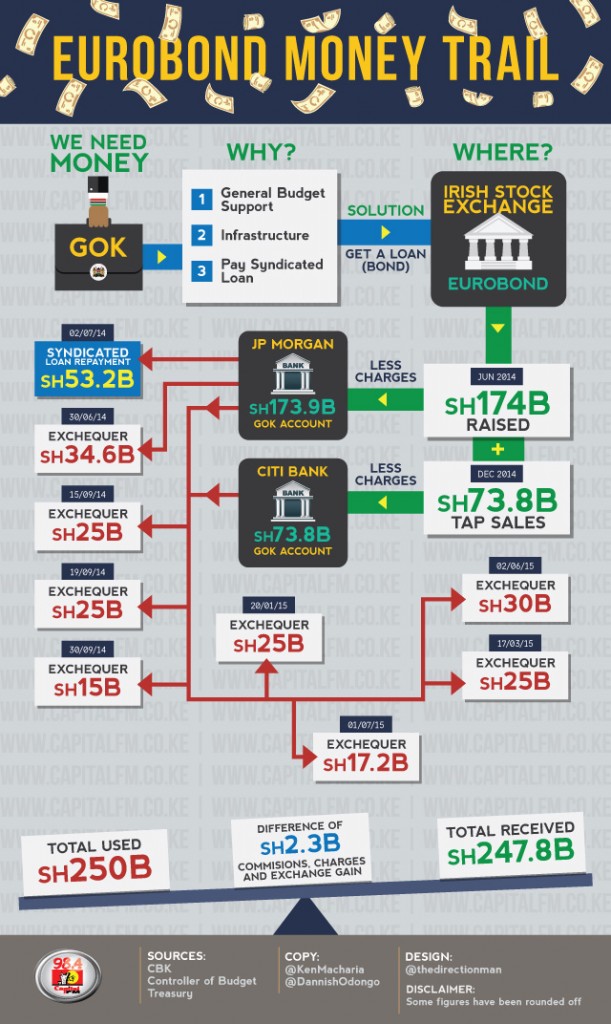

The amount was raised in June 2014

Which specific stock exchange was the money raised from?

Irish Stock Exchange

How much was raised then?

$2 billion equivalent to Sh174 billion at the exchange rate of 87.00

Did the government raise any extra money through the Euro bond?

Yes, it raised another $815 million equivalent to Sh73,0805,169,715.30 at an exchange rate of 90.51. This is commonly known as the Tap Sales.

What was the purpose of the sovereign bond money?

According to the prospectus for the sovereign bond, the purpose of the Bond issuance was for general budget support including funding of infrastructure and the repayment of the Syndicated loan.

It also helped the government in the following macro economics areas:

Lower interest rates

Build up international reserves

Stabilize the Kenya shilling

Reduce inflationary pressure

Were the euro bond objectives met?

Objective 1: Lower interest rates

Between June 2014 to May 2015, the 91 day treasury bill rate declined from 9.8 to 8.3. (Source: CBK)

Objective 2: Build up international reserves

The CBK foreign reserves rose from US$ 6,498 Million (4.3 months of import cover) to US$ 8,555 million (5.7 months of import cover) in June 2014, reflecting the $2B deposit from the Eurobond proceeds (Source: CBK)

Objective 3: Stabilize the Kenya Shilling

The Kenya shillings exchange rate depreciated less than many other currencies. In the period January 2014 to September 2015, the Ksh depreciated by only 22.1% compared with 36.9 % for the Tanzania shilling, 45.2% for the Ugandan shilling among, the Brazilian Real depreciated by 60% and the Turkish Lira by 85.1% (CBK & Thomson Reuters)

Objective 4: Reduce inflationary pressure

Inflation in the period 2014 remained low, stable and within the target. Overall month to month inflation declined from 8.36% in August 2014 to 5.5% in January 2015. Source: (KNBS & CBK)

What’s a syndicated loan?

A loan offered by a group of lenders (called a syndicate) who work together to provide funds for a single borrower. The borrower could be a corporation, a large project, or a sovereignty (such as a government) (Source: Investopedia)

When was the loan due for repayment?

It was due in August 2014

Why then was it paid in July 2014?

The contract documents for the syndicated loan required that the loan be repaid within ten days of the receipt from the sovereign bond. That’s why it was paid on 2nd July, 2014.

READ: The real Eurobond story, according to PS Thugge

From the Irish stock exchange, where was the money deposited?

The first amount ($2B) was deposited in a CBK Account held at JP Morgan Chase Bank, New York on 27.06.2014. The bank statement confirms the position. The statements were also presented to PAC of the national assembly and the Senate Finance Committee.

The tap sales proceeds ($ 815 Million) were credited to Central bank of Kenya account held at Citibank, New York on 17.12.2014.

Why was the money deposited in foreign accounts?

It is a standard international practice to open international currency designated accounts that will facilitate receipt of the Euro Bond proceeds. The national treasury in line with Section 45(d) of the central bank of Kenya Act and Section 28 of the public finance management Act 2012 instructed the central bank of Kenya as the banker of government to open receiving account for the proceeds of the sovereign bond.

Did the treasury break any law?

The national Treasury operated in line and within Section 28 of the Public Finance Management Act, 2012 by instructing CBK to open the accounts inline with section 45 (d) of the Central Bank of Kenya Act.