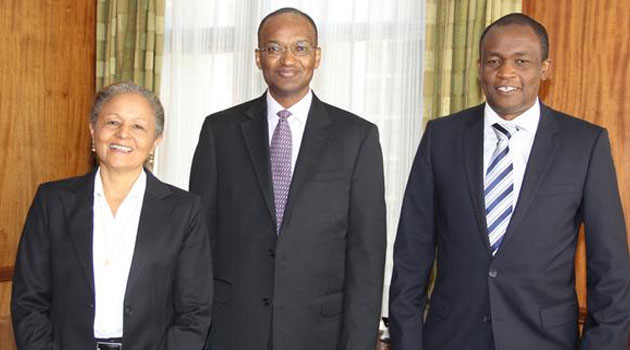

Njoroge said it was unfortunate that large banks were hiking their rates despite them having liquidity/FILE

Njoroge said it was unfortunate that large banks were hiking their rates despite them having liquidity.

The commercial banks lending rates hit 17.4 percent in December 2015, up from 17.2 percent in November 2015 and 15.7 percent in August 2015.

The interest rates environment in Kenya has witnessed volatility over the last calendar year, with a sharp increase in rates being the trend.

The 91-Day Treasury Bills rose from a rate of 8.6 percent in December 2014, to 22.5 percent in November 2015 but has since fallen to a single digit.

CBK lending rates have also increased by 300 basis points to stand at 11.5 percent.

The Monetary Policy Committee on Wednesday retained the key lending rate at 11.50 percent citing the current inflation pressures are temporary, and that the monetary policy measures currently in place are containing any demand pressures in the economy.

The MPC which met to review market developments and the outcomes of its previous monetary policy decisions noted that month-on-month overall inflation was 8.0 percent in December 2015, up from 7.3 percent in November.

“The increase was driven largely by food prices, and the main items were Irish potatoes, tomatoes, sukuma wiki, carrots, cabbages, onions, beef with bones, and avocados,” the MPC said.

The items contributed 2.3 percentage points to overall inflation and 6.3 percentage points to food inflation in December 2015. New Excise Taxes on alcoholic beverages and tobacco products, introduced on December 1, 2015 contributed 0.3 percentage points to overall inflation and 1.2 percentage points to the non-food-non-fuel (NFNF) inflation.

Speaking to the press on Thursday, governor Njoroge said the shilling will remain stable in 2016 backed by a falling current account deficit and Diaspora remittances.

“The CBK foreign exchange reserves US$7,023.7 million – equivalent to 4.5 months of import cover – together with the precautionary engagements with IMF continue to provide an adequate buffer against short term shocks. However, the uncertainty around the pace of the increase in the US interest rates remains a risk for most emerging and frontier market currencies,” he said.

He says that tea exports have improved and Diaspora remittances remain strong while fresh vegetable exports are recovering adding that the January 2016 MPC survey shows that banks and non- bank private firms expect a better growth in 2016.

“All banks and all non bank private sector expect improved growth in 2016 due to infrastructure development benefits , robust activity in construction, rebound in the tourism sector due to improved security, lower international oil prices and a stable exchange rate,” Njoroge said.

In 2016, the governor sees the current account deficit to hit 8.8 percent of GDP higher than 2015 attributable to imports for the Standard Gauge railway which is now at its peak.

Analysts expect Kenya’s economy to grow between 5.5 percent and 6 percent in 2016, backed by government’s heavy infrastructure projects.

Standard Chartered Bank Chief Economist for Africa, Razia Khan, said interest rates will remain relatively stable in the medium term and will be begin to drop in the second half of 2016 but sees Kenya’s currency depreciating and could hit the Sh110 mark.