Director for Research and Financial Markets Jared Osoro said that 60 percent of the Kenyans surveyed use their mobile phones for financial and banking transactions/FILE

Presenting the findings, KBA Director for Research and Financial Markets Jared Osoro said that 60 percent of the Kenyans surveyed use their mobile phones for financial and banking transactions.

Rural residents use mobile phones more for financial transactions (71 percent) than their counterparts in urban areas (51 percent), with Eastern scoring the highest, and Coast the lowest.

Utility payment that includes electricity and water ranked the highest via mobile phones at 48 percent and to a lesser extent mobile phone bills at 22 percent.

“The use of mobile phones for the payments of other bills like school fees at 16 percent , goods for home at 13 percent and office at 8 percent while entertainment also at 8 percent is quite low with less than 20 percent of the respondents paying through their mobile phones,” Osoro said.

The payments are on average paid on monthly basis and amount paid ranges between a mean of Sh1,631 and Sh20,000 with the highest amount paid on mobile phones being school fees which on average stands at Sh19,278.

The report also indicates that cash withdrawals and deposits are the main banking transactions undertaken by the respondents, clocking 76 percent and 67 percent respectively.

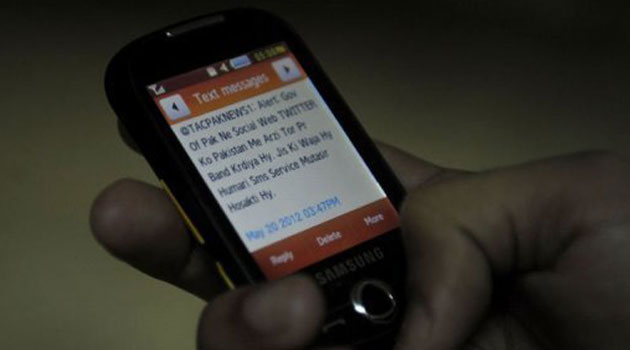

The study also shows that money is mainly transferred through mobile phones with 64 percent of the respondents saying that they send and receive money through mobile phones locally.

However international money transfers are done through Western Union, Money Gram and NationHela.

“Bankers and mobile service providers together with the regulators should tap on this market,” he said.

According to the study, cash is largely withdrawn at the Automated Teller Machines (ATM) lobbies which stood at 58 percent while mobile operators transact about a fifth of all cash withdrawals.

“The report indicates that while cost savings is a crucial consideration for mobile banking uptake, security, time saving and convenience are also considered vital,” he revealed.

He says that banks should consider ease of use, cost, security, privacy and reliability when adopting mobile banking platforms.

The report also indicates that there is a high demand for mobile banking across non-users of mobile banking that includes Nyanza, Eastern and Western.

According to the study, the interest is likely to be driven and sustained by security from fraud, more locations and physical security.

Central Bank of Kenya data shows that Sh1.117 trillion changed hands through mobile phone money transfers between January and September 2013 as a result of increased interface between commercial banks and cash remittance services of mobile telephone services firms.