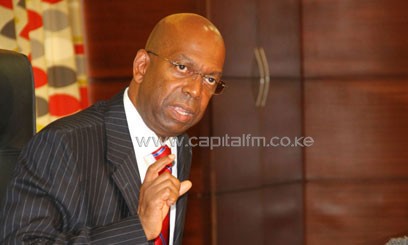

Collymore, whose initial contract of three years was due to expire at the end of August, has been key in raising the firm’s profits/FILE

Collymore, whose initial contract of three years was due to expire at the end of August, has been key in raising the firm’s profits.

“The board recognised that this is still work in progress and we still have much that can be done. We are giving ourselves more time to work out our succession plan,” Collymore said.

Collymore, who joined the firm that is 40-percent owned by Britain’s Vodafone from South Africa’s Vodacom, steered Safaricom through a bruising price war initiated by the Kenyan unit of Bharti Airtel in August 2010.

He has more than 25 years of commercial experience working in the telecommunications sector.

He is also a trustee of Holding companies in Kenya and Tanzania for M-PESA, Vodafone’s pioneering money transfer service.

“Contracts for the entire executive team, including the chief technology officer and the chief financial officer will be expiring over the next 18-24 months,” he said.

“We will be in the process of identifying people who will be taking over internally,” he added.

The announcement came after Safaricom once again broke its own revenue record with a Sh17.5 billion after- tax profit for the year ended March 31.

It was the first time that Safaricom’s profit grew after two consecutive years of decline. Safaricom’s return to profit growth was driven by steep increase in n M-PESA, SMS and data revenues showing that its heavy investment in data business is beginning to pay dividends.

The share price peaked at Sh7.20 in last week’s trading but was below the historic high of Sh8.15 recorded shortly after the company’s listing in 2008.