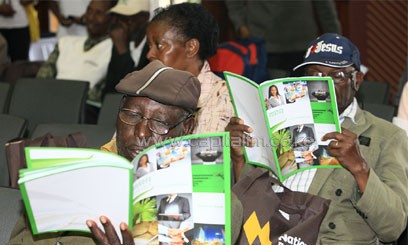

The shareholders also backed the bank’s plans to set up regional subsidiaries at the 44 Annual General Meeting held in Nairobi/CFM

The shareholders also backed the bank’s plans to set up regional subsidiaries at the 44 Annual General Meeting held in Nairobi.

A Rights Issue, also known as a cash call, is a way of raising capital for business expansion by asking shareholders to buy additional shares.

The shareholders’ resolutions will add significant traction to the Bank’s five-year growth strategy seeking to grow its turnover from the current Sh8 billion to Sh31 billion by 2017.

It will also see the bank open thirty new branches across the country during the same period.

National Bank Chairman Mohammed Hassan told shareholders that management had embarked on diversifying its business in line with its objectives of joining the top-tier league of banks in Kenya.

The bank, which unveiled its new brand on May 24 this year as part of the transformation program, will pursue growth in the SME and corporate segments.

National bank has traditionally relied on government and retail business and the latter has made it especially exposed to risks posed by high interest rate environment.

“The Board took action to ensure we not only address concentration risk that made us vulnerable to the volatile markets but also laid down strong foundations for an ambitious growth for the Bank to become a top tier bank over the next five years,” Hassan said.

He further said the actions taken will generate significantly higher profits and growth for the bank which boasts Sh67 billion in assets.

The bank’s profit after tax for the 2012 financial year declined to Sh729.8 million down from Sh1.5 billion in a similar period in 2011 representing a 52.8 drop.