The biggest component changes in the consumer price index for November inflation were transport which stood at 2.19 percent while energy costs rose by 1.6 percent during the month. Food prices were at 1.35 percent.

Prices of cooking gas, kerosene and charcoal went up by 7.01 percent, 5.4 percent and 4.33 percent respectively, between October and November.

On average, Kenyans are now paying 29.44 percent and 27.07 percent more for petrol and diesel than this time last year.

Last month the Central Bank of Kenya (CBK) had increased its inflation target to nine percent from five percent with a variant of plus or minus two percent meaning the CBK would prefer an inflation peak of 11 percent.

All focus now shifts to the Monetary Policy Committee and their decision when they meet again on Thursday.

On Friday last week, CBK Governor Njuguna Ndung’u was put on the spot by the Parliamentary Committee on Finance over the rising cost of inflation and the performance of the shilling.

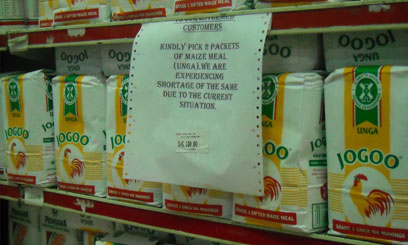

The top banker added that the drought situation that has rocked the country as well as the price increase in sugar contributed towards the rising cost of inflation.

“Food inflation stood at 26.2 percent while fuel inflation stood at 15.8 percent with non-food non-fuel inflation at 9.75 percent. The combination of inflation and weakening exchange rate is a threat to economic recovery: Hence the need for a coordinated response,” he said.

The country has been importing more goods than it exports which results in a deficit for the country’s GDP.

In a report tabled before the committee, the CBK stated that given the instability in the European region, short term financial derivatives were prevalent increasing the velocity of foreign exchange trading and exerting pressure on the demand for the US dollar.

The report gave the following measures to maintain the current direction the economy and foreign exchange market is taking;

– Build up foreign exchange reserves to a stronger position that will provide an adequate buffer.

– Regular interactions with market players to be sustained to enhance the effectiveness of the transmission mechanism of the monetary policy and policy actions.

-And continued regional coordination in policy actions and responses among the Central Banks within the East African Community.

The parliamentary committee will conclude its sittings on December 15.