NAIROBI, Kenya, May 20 – Even if you are new to investing, you may already know some of the most fundamental principles of sound investing through ordinary, real-life experiences that have nothing to do with the stock market.

It is easy to notice that few businesses have one product line the reason being diversification to reduce risk of loss. Asset allocation operates within the same principle as diversification and the two are related to a great extent.

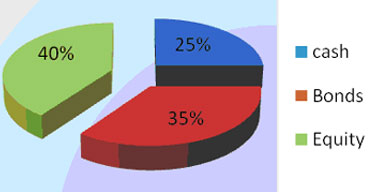

Asset allocation involves dividing an investment portfolio among different asset categories such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a personal one but which usually requires the help of an investment advisor. The key determinants are your time horizon and your ability to tolerate risk.

An investor with a longer time horizon may feel more comfortable taking on a riskier, or more volatile, investment because he or she can wait out slow economic cycles and the inevitable ups and downs of our markets. By contrast, an investor with a short time horizon would likely take on less risk.

Risk tolerance is your ability and willingness to lose some or all of your original investment in exchange for greater potential returns. An aggressive investor, or one with a high-risk tolerance, is more likely to risk losing money in order to get better results.

A conservative investor, or one with a low-risk tolerance, tends to favour investments that will preserve his or her original investment. In the words of the famous saying, conservative investors keep a "bird in the hand," while aggressive investors seek "two in the bush."

When talking about asset allocation, it is important to know what asset classes or categories are available to an investor. There are three common categories; stocks, bonds, and cash. Other asset classes that may be included in an investment portfolio include precious metals, commodities (oil and energy).

It is important to note that investments in these asset categories typically have category-specific risks and therefore before you make any investment, you should understand the risks of the investment and make sure the risks are appropriate for you.

Stocks – Stocks have the greatest risk and highest returns among the three major asset categories. However, the volatility of stocks makes them a very risky investment in the short term. Investors with long-term investment objectives need not to worry about short-term volatility because of the strong positive returns.

Bonds – These are generally less volatile than stocks but offer more modest returns. As a result, an investor approaching a financial goal might increase his or her bond holdings relative to his or her stock holdings because the reduced risk of holding more bonds would be attractive to the investor despite their lower potential for growth. Some categories of bonds offer high returns similar to stocks. But these bonds, known as high-yield or junk bonds, also carry higher risk.

Cash and its equivalents such as savings, deposits, certificates of deposits and treasury bills have the lowest risk amongst the three asset categories. The chances of losing money on an investment in this asset category are generally extremely low. The principal concern for investors investing in cash equivalents is inflation risk. This is the risk that inflation will outpace and erode investment returns over time.

Asset allocation is a very important investment strategy because by including asset categories with investment returns that move up and down under different market conditions, an investor can protect against significant losses. Historically, the returns of the three major asset categories have not moved up and down at the same time.

By investing in more than one asset category, you’ll reduce the risk that you’ll lose money and your portfolio’s overall investment returns will have a smoother ride. If one asset category’s investment return falls, you’ll be in a position to counteract your losses in that asset category with better investment returns in another asset category.

Asset allocation is more of an art than a science because it requires more of mental effort and personal analysis rather than mathematical computation. One of the best ways to develop an effective asset allocation plan is to consult a qualified financial planner.

Financial advisers are trained to understand your financial goals, your time frame and comfort with volatility. Given the variety of investment options available and that each investors financial goals and circumstances are unique, it is always recommended that you discuss your investment options with a qualified professional to find the solution that is right for you.